ARCHIVED - 2009 Reference Case Scenario: Canadian Energy Demand and Supply to 2020 - An Energy Market Assessment

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

July 2009

Copyright/Permission to Reproduce

2009 Reference Case Scenario: Canadian Energy Demand and Supply to 2020 - An Energy Market Assessment [ZIP 3208 KB]

(Maintains links between report charts and their associated data, and between appendices and data files.)

2009 Reference Case Scenario: Canadian Energy Demand and Supply to 2020 - An Energy Market Assessment - Appendices [ZIP 2645 KB]

(Maintains links between report charts and their associated data, and between appendices and data files.)

Table of Contents

List of Figures

List of Tables

List of Acronyms and Abbreviations

List of Units

Chapter 2: Energy Context

Oil and Gas Markets - Global and Regional Trends

Government Programs and Policies

Chapter 3: Key Drivers

Energy Prices

Economic Growth

Key Uncertainties to the Outlook

Chapter 4: Energy Demand Outlook

Energy Consumption by Sector

Key Uncertainties to the Outlook

Chapter 5: Crude Oil Supply Outlook

Resources

Crude Oil Supply Outlook

Supply and Demand Balances

Key Uncertainties to the Outlook

Chapter 6: Natural Gas Supply Outlook

Resources

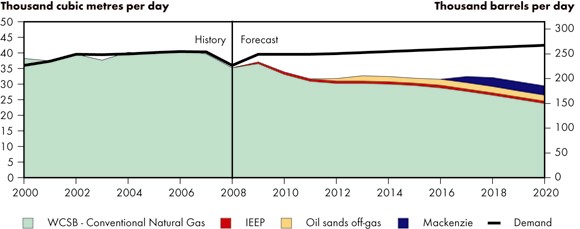

Canadian Natural Gas Production Outlook

Liquefied Natural Gas

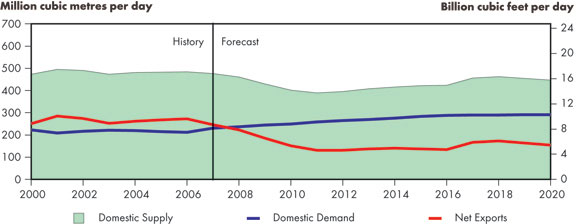

Supply and Demand Balance

Key Uncertainties to the Outlook

Chapter 7: Natural Gas Liquids Supply Outlook

NGL Supply and Disposition

Key Uncertainties to the Outlook

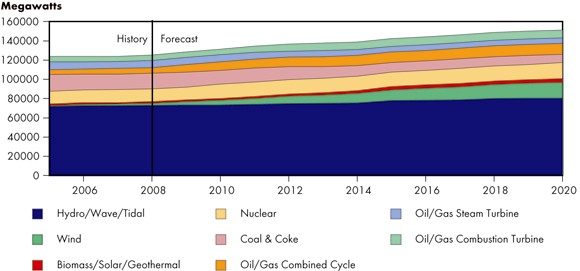

Chapter 8: Electricity Supply Outlook

Capacity and Generation

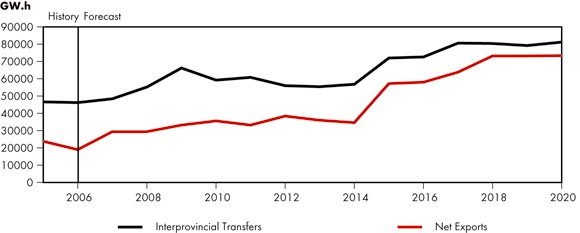

Exports, Imports and Interprovincial Transfers

Key Uncertainties to the Outlook

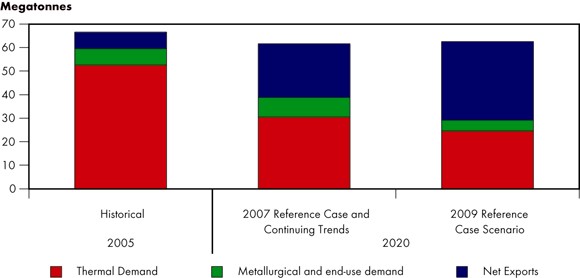

Chapter 9: Coal Supply Outlook

Key Uncertainties to the Outlook

List of Figures

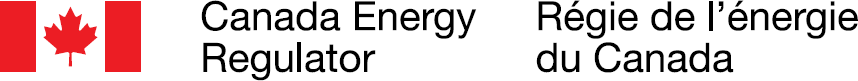

| ES.1 | Comparison of Historic and Projected Growth Rates - Population, Gross Domestic Product (GDP), End-use Demand |

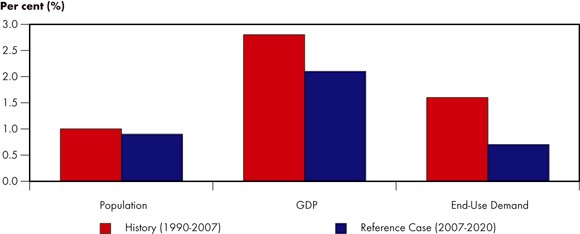

| 3.1 | West Texas Intermediate Crude Oil Price at Cushing, Oklahoma, Reference Case Scenario and Price Cases |

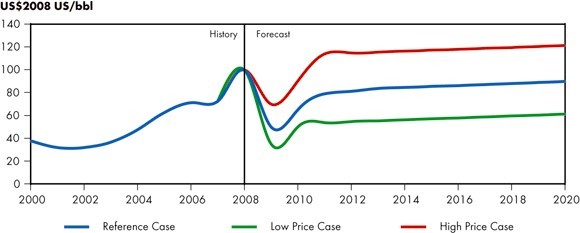

| 3.2 | Henry Hub Natural Gas Price at Louisiana, Reference Case Scenario and Price Cases |

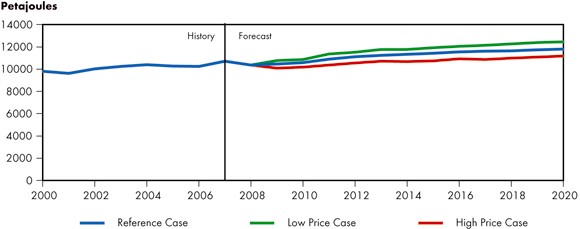

| 4.1 | Canadian Total Secondary Energy Demand, Reference Case Scenario and Price Cases |

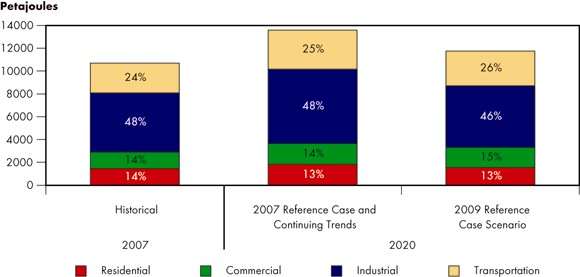

| 4.2 | Comparison of 2009 Reference Case Scenario and 2007 Reference Case End-Use Demand |

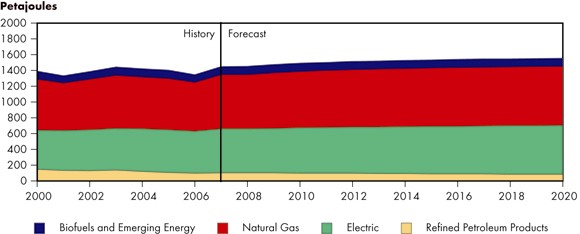

| 4.3 | Residential Sector Energy Demand by Fuel, Reference Case Scenario |

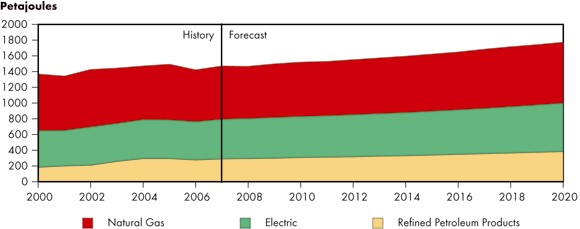

| 4.4 | Commercial Sector Energy Demand by Fuel, Reference Case Scenario |

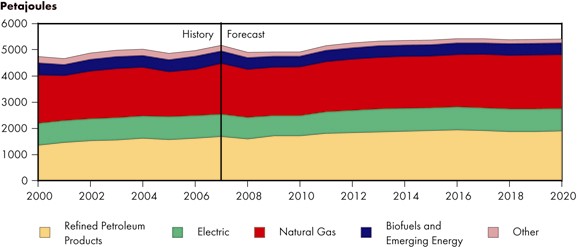

| 4.5 | Industrial Sector Energy Demand by Fuel, Reference Case Scenario |

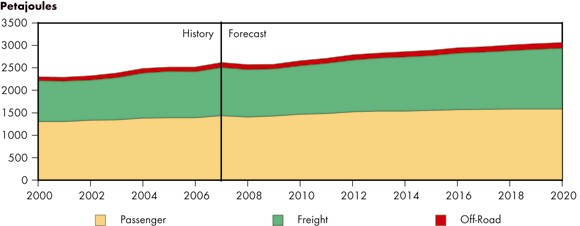

| 4.6 | Transportation Sector Energy Demand by Mode, Reference Case Scenario |

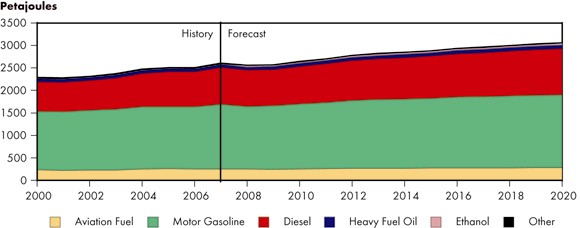

| 4.7 | Transportation Sector Energy Demand by Fuel, Reference Case Scenario |

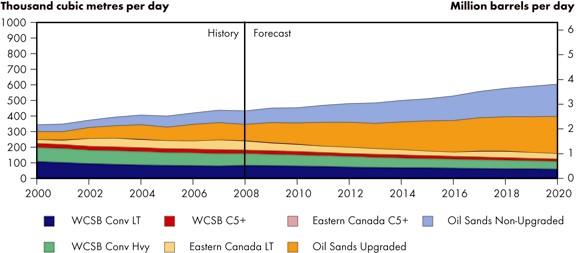

| 5.1 | Total Canadian Oil Production, Reference Case Scenario |

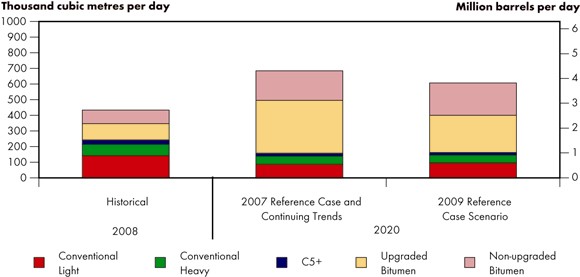

| 5.2 | Comparison of 2009 Reference Case Scenario and 2007 Reference Case Crude Oil Supply Outlook |

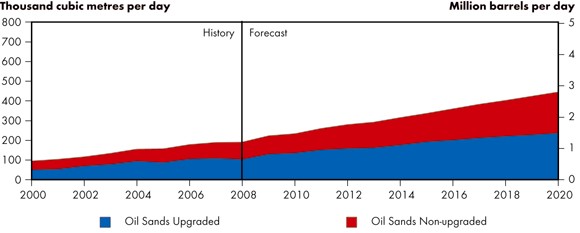

| 5.3 | Oil Sands Production, Reference Case Scenario |

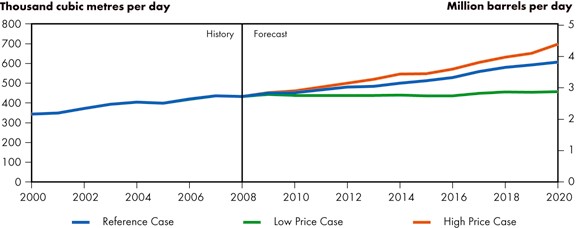

| 5.4 | Oil Production, Reference Case Scenario and Price Cases |

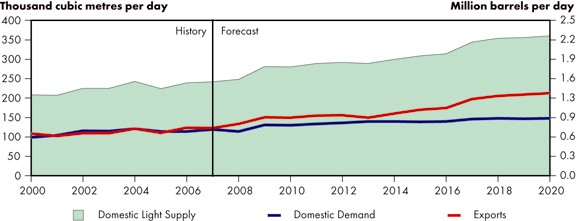

| 5.5 | Light Crude Oil Balance, Reference Case Scenario |

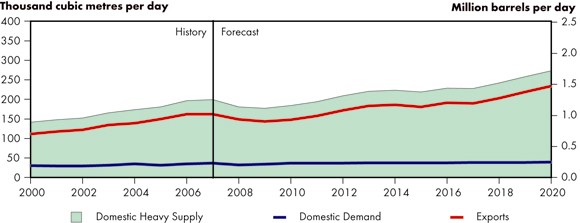

| 5.6 | Heavy Crude Oil Balance, Reference Case Scenario |

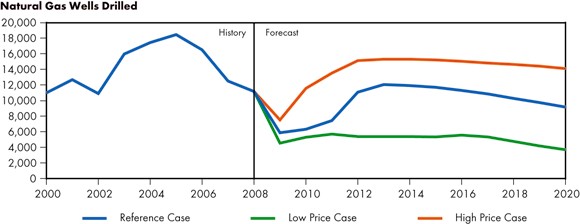

| 6.1 | Projected Natural Gas Wells Drilled, Reference Case Scenario and Price Cases |

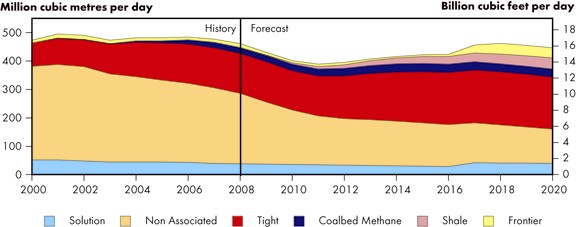

| 6.2 | Canadian Natural Gas Production, Reference Case Scenario |

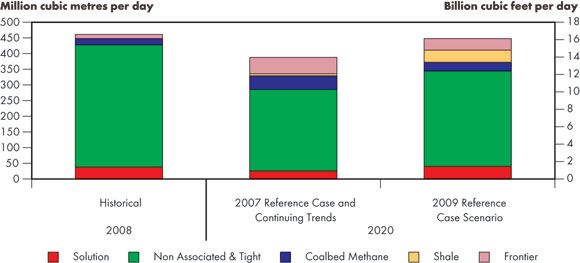

| 6.3 | Comparison of 2009 Reference Case Scenario and 2007 Reference Case Natural Gas Supply Outlook |

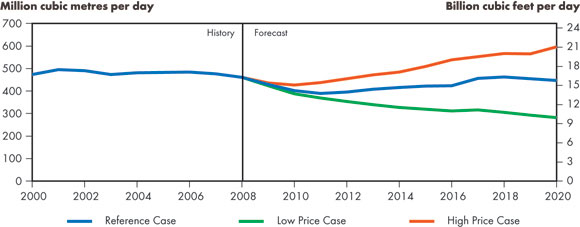

| 6.4 | Canadian Natural Gas Production, Reference Case Senario and Price Cases |

| 6.5 | Canadian Net Natural Gas Exports, Reference Case Scenario and Price Cases |

| 7.1 | Ethane Supply and Demand Balance, Reference Case Scenario |

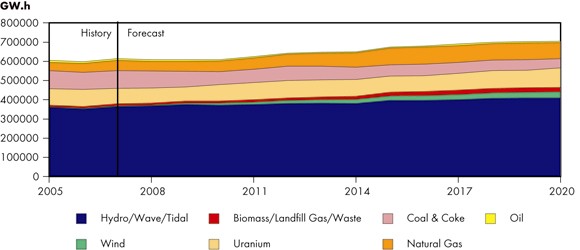

| 8.1 | Canada Electricity Generating Capacity, Reference Case Scenario |

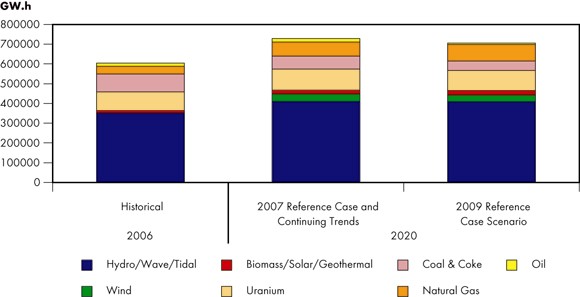

| 8.2 | Generation by Fuel Comparison of 2009 Reference Case Scenario and 2007 Reference Case Scenario |

| 8.3 | Canada Electricity Generation by Fuel, Reference Case Scenario |

| 8.4 | Interprovincial Electricity Transfers and Net Exports, Reference Case Scenario |

| 9.1 | Canadian Coal Production and Disposition, 2005 and 2020, Reference Case Scenario |

List of Tables

| 5.1 | Estimated Initial Capital Expenditure and Threshold Prices for New Oil Sands Projects |

List of Acronyms and Abbreviations

| CBM | Coalbed methane |

| CCS | Carbon capture and storage |

| CNG | Compressed natural gas |

| CO2 | Carbon dioxide |

| EOR | Enhanced Oil Recovery |

| GDP | Gross Domestic Product |

| GHG | Greenhouse gas |

| IEEP | Incremental Ethane Extraction Policy |

| IGCC | Integrated Gasification Combined Cycle |

| LNG | Liquefied Natural Gas |

| NEB | National Energy Board |

| NGLs | Natural Gas Liquids |

| NYMEX | New York Mercantile Exchange |

| OECD | Organisation for Economic Co-operation and Development |

| OPEC | Organization of the Petroleum Exporting Countries |

| U.S. | United States |

| WCSB | Western Canada Sedimentary Basin |

| WTI | West Texas Intermediate |

List of Units

| bbl | barrels |

| b/d | barrels per day |

| Bcf | billion cubic feet |

| Bcf/d | billion cubic feet per day |

| GJ | gigajoule |

| GW | gigawatt |

| GW.h | gigawatt hour |

| m³ | cubic metre |

| m³/d | cubic metres per day |

| Mb/d | thousand barrels per day |

| Mcf | thousand cubic feet |

| MMb/d | million barrels per day |

| MMBtu | million British thermal units |

| Mt | megatonne |

| MW | megawatt |

| PJ | petajoules |

| $ or Cdn$ | Canadian dollars |

| US$ | U.S. dollars |

| Tcf | trillion cubic feet |

| TW.h | terawatt hour |

Foreword

The National Energy Board (the NEB or the Board) is an independent federal agency whose purpose is to promote safety and security, environmental protection, and efficient energy infrastructure and markets in the Canadian public interest[*] within the mandate set by Parliament in the regulation of pipelines, energy development and trade.

The Board's main responsibilities include regulating the construction and operation of interprovincial and international oil, gas and commodity pipelines, international power lines, and designated interprovincial power lines. Furthermore, the Board regulates the tolls and tariffs for the pipelines under its jurisdiction.

With respect to the specific energy commodities, the Board regulates the export of natural gas, oil, natural gas liquids (NGLs) and electricity, and the import of natural gas. Additionally, the Board regulates oil and gas exploration and development on frontier lands and offshore areas not covered by provincial or federal management agreements.

In an advisory function, the Board also keeps under review and analyzes matters related to its jurisdiction and provides information and advice on aspects of energy supply, transmission and disposition in and outside Canada. In this role, the NEB publishes periodic assessments to inform Canadians on trends, events and issues which may affect Canadian energy markets.

The NEB has a long history of providing energy supply and demand projections to Canadians. The first long-term energy supply and demand report was published in 1967. The most recent report entitled Canada's Energy Future: Reference Case and Scenarios to 2030 was released in November 2007. As the title suggests, the report examined possible energy futures that might unfold for Canadians up to the year 2030 and provided a Reference Case which extended to 2015. In this report, the NEB is updating and extending the Reference Case Scenario analysis contained in the 2007 report.

As with the 2007 report, the NEB sought the views of Canadian energy experts and interested stakeholders through consultation sessions held in the spring of 2009. The NEB would like to take this opportunity to thank the participants in the consultation process. The views collected helped shape the report assumptions and analysis.

Comments or questions on this report can be directed to:

Abha Bhargava, Project Manager

If a party wishes to rely on material from this report in any regulatory proceeding, it can submit the material as can be done with any public document. In such a case, the material is in effect adopted by the party submitting it and that party could be required to answer questions on it.

Information about the NEB, including its publications, can be found by accessing the Board's website at www.neb-one.gc.ca.

Executive Summary

This report is an update and extension of the Reference Case contained in the NEB's 2007 report entitled Canada's Energy Future: Reference Case and Scenarios to 2030. The 2009 Reference Case Scenario is based on current best estimates of energy price projections, an economic outlook and government programs existing at this time. Energy demand and supply projections are provided to the year 2020. In view of the current uncertainty of oil and gas prices, High and Low Price Cases are also presented.

As in its previous assessments of long term energy supply and demand, this report allows the Board to communicate with Canadians on emerging energy trends and implications for Canada's energy markets and infrastructure. In developing this outlook, the NEB met with energy experts and interested stakeholders, including representatives from industry, government, environmental non-government organizations, and academia, in early 2009 to help shape key assumptions and obtain feedback on projected outcomes.

The key findings of 2009 Reference Case Scenario are:

- Energy demand growth slows significantly

Several factors lead to this result, including lower workforce and population growth, higher crude oil prices, slower economic growth, additional demand management programs, and heightened awareness of the environmental impacts of energy consumption. End-use energy demand in Canada is projected to increase at an average of 0.7 per cent per year from 2007 to 2020, considerably lower than the historical rate of 1.6 per cent since 1990 (Figure ES.1). Energy intensity, or the amount of energy used in relation to Canada's economic output, decreases by 1.3 per cent a year. Energy efficiency improvements in electric and natural gas end-use devices and declining heavy industry sectors are the main contributors to this decrease. Should the slowing energy demand projection become a reality, the GHG emissions growth rate will be lower compared to history as well as to the 2007 Reference Case. - Future oil and gas supply reflects a larger unconventional mix

Conventional production for both oil and gas is expected to continue its historical decline. This decline is nevertheless more than compensated by the increase in non-conventional production. By the end of the forecast period, oil sands contribute approximately three quarters of the Canadian production of oil, as compared to less than fifty per cent now. As well, both shale and tight gas are projected to increase significantly, constituting two-thirds of total natural gas production by the end of the forecast period as compared to one-third at this time. The growing contribution of this unconventional source in North America could decouple the historic relationship between natural gas and oil prices. As well, Canadian natural gas exports, which were projected to decrease sharply in the previous forecast, are now expected to stabilize in the medium to longer term.

Due to lower oil prices and availability of capital, several oil sand projects have been delayed compared to the projections in the previous forecast. Canada's huge oil sands resource represents an increasingly significant source of non-OPEC petroleum supply. Further commercialization of this resource depends primarily on the speed of recovery from the global recession, oil price, and construction costs and environmental compliance. - Electricity supply in Canada is becoming cleaner

With the retirement of coal plants in Ontario and expectations of significant growth in other generating technologies, the Canadian electric system is transitioning to lower emission intensity. Reduced growth in demand for electricity through energy efficiency also affects requirements for new generation.

Hydroelectric, nuclear and natural gas capacity are projected to increase in the future. Although the share of unconventional emerging technologies is expected to remain small at less than 15 per cent by 2020, large changes are projected in the magnitude of these generation technologies. Most notable is wind capacity, which is projected to form ten per cent of total installed capacity by 2020. Other generation technologies such as biomass, landfill gas, waste heat, solar and tidal also grow significantly. By 2020, technologies such as carbon capture and storage (CCS) are expected to be used more broadly to contain emissions from fossil fuel power generation.

Figure ES.1 - Comparison of Historic and Projected Growth Rates – Population, Gross Domestic Product (GDP), End-use Demand

Notwithstanding the factors mentioned above, the overarching conclusions from the 2007 Reference Case remain intact. Canadians can expect the energy markets to function well with energy prices balancing demand and supply. Energy from conventional fossil fuels is expected to be the dominant source of supply, although non-conventional sources will continue to gain share. The integration of energy, environment and economy will continue to grow and Canadians will increasingly include environmental considerations in their decision making.

Chapter 1. Introduction

- Canada's Energy Future: Reference Case and Scenarios to 2030 was released in November 2007. The report examined possible energy futures that might unfold for Canadians up to the year 2030. This included a baseline projection, called the Reference Case, which examined energy supply and demand trends to the year 2015 based on macroeconomic outlook, energy prices, and government policies and programs in place at that time. In addition, three scenarios, each with its own internally consistent set of assumptions were considered.

- This report is an update to and extension of the NEB's 2007 Reference Case analysis. Major changes have occurred since the last report, including a rapid run-up and then decline in global oil prices; a global financial crisis and resulting global economic slowdown, and; enactment of new energy and environment policies. This update includes both Low and High energy price Cases to provide broader perspective, due to the ongoing volatility of energy prices[2]. This report extends the Reference Case analysis timeframe out to 2020[3].

[2] Note that the high and low price cases considered in this Update are sensitivities rather than scenarios, which was the methodology employed in the 2007 report. The key difference is that sensitivity isolates the affect of a change in one variable on the key outputs whereas scenario analysis considers the interactions of multiple variables at the same time (e.g., changes in prices, economic growth, technology development, government policies, geopolicitics, consumer behaviour, etc.). Both provide ways of analyzing uncertainty.

[3] In this report, the last year of history varies depending on availability of statistical information, for example the last historic year for electricity supply information is 2006, end-use demand data is 2007, and oil and gas supply data is 2008. - The following chapters discuss key changes influencing the Reference Case analysis and highlight Canadian energy demand and supply trends. Data tables can be found in the appendices, which are available on the NEB website[4].

Chapter 2. Energy Context

- The Canadian energy market does not operate in isolation. It is strongly affected by global and regional energy pricing trends, macroeconomic trends, developments in technology, and changes to government programs and policies. This chapter provides important background information to help understand the results of the 2009 Reference Case Scenario. Additional background information can be found in the NEB's 2008 Canadian Energy Overview, available on the NEB website.

Oil and Gas Markets - Global and Regional Trends

Crude Oil

- Over the last decade, oil prices rose and fell dramatically in response to changes in global economic conditions. Between 2000 and 2007, global crude oil prices experienced significant growth. This was supported by increased global energy demand and tight energy supplies. Many emerging and developing economies, such as India and China, experienced sustained economic growth rates of over 7.0 per cent per year between 2000 and 2007, contributing to the rapid increase in global fuel demand. At the same time, global crude oil supply struggled to keep pace with rising demand due to maturing conventional oil resources and geopolitical tensions which limited access to some global supplies (e.g., economic and political nationalism, local opposition to development).

- At the beginning of 2008, oil prices broke the US$100/bbl mark for the first time ever. Prices continued to escalate throughout the first half of the year reaching an all-time high of US$147/bbl in July. Although higher prices led to decreased demand in OECD countries, many emerging economies continued to experience demand growth, partly due to fuel subsidies that insulated consumers from the full price effect. In the face of this rising demand, global supplies remained tight, which supported upward movement in crude oil prices. These supply and demand fundamentals were compounded by higher returns on commodities, which led to investment money flowing into the oil market, increasing the volatility of oil prices. The decline in the value of the U.S. dollar also contributed to higher oil prices.

- The latter half of 2008 saw oil prices swing in the opposite direction as the global effects of the U.S. housing market collapse and financial crisis became apparent. Businesses had trouble accessing credit and consumers' wealth decreased as a result of declining housing prices, falling equity markets and increasing job losses. These factors shook confidence levels and resulted in reduced consumption and investment.

- Countries are more integrated today than any time in the past through trade and financial flows. The factors that pushed the U.S., the world's largest economy, into recession have had a domino effect around the globe. Despite some beliefs early in the global economic downturn that emerging and developing economies might escape the effects of the U.S. recession (because of the relative size and strength of their domestic demand and increased importance of interregional trade in Asia), the world is experiencing the most synchronous economic recession in 50 years[5].

[5] International Monetary Fund, World Economic Outlook, April 2009.

- The decline in global economic activity has meant a reduction in energy demand growth. By the end of September 2008, global crude inventories were building and oil prices were falling. Over the course of three meetings in late 2008, OPEC agreed to cut oil production by 670 thousand m³/d (4.2 MMb/d), in an attempt to halt falling oil prices. However, worsening economic conditions and continued inventory builds meant that the WTI near-month contract ended the year at US$45/bbl. In Canada, the lower energy prices reduced company budgets, leading to reduced drilling and postponement of Canadian energy projects. The first quarter of 2009 saw global crude oil prices stabilize around US$40/bbl. By May 2009, average prices had increased to the US$60/bbl level.

- The near and long-term futures of global crude oil prices are dependent on global economic recovery. Government and central banks around the world are enacting fiscal and monetary policies to address the financial crisis and global economic slowdown. However, the length and depth of the global economic recession and the pace of economic recovery continues to be an unknown factor. Projections[6] suggest that overall global economic growth will fall by 1.7 per cent in 2009. The first two quarters of 2009 show negative growth and a recovery beginning in the last two quarters of the year. The global economy will continue to slowly recover throughout 2010 with a projected growth rate of 2.3 per cent. This compares to average annual economic growth of over 3.0 per cent since the year 2000.

[6] World Bank, Global Economic Prospects 2009, March 30 2009.

Natural Gas

- In natural gas markets, the economic slowdown significantly reduced industrial demand at the same time that natural gas supply in the U.S. was rising. The biggest change to North American natural gas markets since the previous Reference Case is the potential for significant increases in tight gas and shale gas production. This development is progressing rapidly in the U.S. and is beginning to get underway in Canada. Commercialization was achieved through technological advances in rock fracturing to improve gas recovery, which have opened up the potential for a vast supply of natural gas in several new regions.

- The market imbalance caused by excess supply in the face of falling demand has caused natural gas prices to fall by almost 75 per cent from the July 2008 peak of US$13.32/MMBtu and natural gas-directed drilling activity to fall by 50 per cent in 2009. Reduced drilling will eventually lead to production declines and, coupled with an increase in demand, provide a rebalancing of supply and demand that could cause prices to begin to rise in 2010. This would signal the start of the next economic cycle for natural gas with increasing drilling and growing supply and demand in 2011 and 2012.

Government Programs and Policies

- Energy and the environment are becoming increasingly interconnected. Indications suggest that North America is on the cusp of significant environmental policy changes. These changes could have a profound influence on how Canadians produce and consume energy.

- There have been a number of environmental announcements since the 2007 report at the national and international levels. The new U.S. administration is supporting the creation of federal cap-and-trade legislation. Additional details regarding Canada's GHG emissions reductions in the industrial sector, as outlined in the federal Regulatory Framework for Industrial Greenhouse Gas Emissions, have been released. Four Canadian provinces and seven U.S. states have partnered in the Western Climate Initiative, which is developing a regional carbon market cap-and-trade program[7]. There is also movement to improve vehicle fuel economy standards in North America as well as to develop a Low Carbon Fuel Standard.

[7] The participating regions are British Columbia, Manitoba, Ontario, Quebec, Arizona, California, Montana, New Mexico, Oregon, Utah and Washington.

- At the provincial level, there have been several policy directives put in place. This includes the BC Energy Plan, Alberta's Climate Change and Emissions Management Amendment Act and Manitoba's Beyond Kyoto. As well, further details surrounding existing programs and policies have been announced. Most provinces in Canada now have an energy efficiency mandate.

- These policy directives are noteworthy and provide an outlook of potential future directions. However, many of these policies are not yet at the program stage. The 2009 Reference Case Scenario includes only current government programs in its analysis, therefore the evolving policies, such as those mentioned above, have not been quantitatively analyzed. Polices such as cap and trade programs and low carbon fuel standards have been commented on within this report in the emerging trends discussions. This aligns well with the standard methodology employed by other energy groups, such as the U.S. Energy Information Agency.

- Examples of included polices and programs are detailed in Chapter 4. These include programs such as stricter building codes, new efficiency standards for energy using equipment, regulations impacting larger use of renewables and carbon taxes in Quebec and BC. As a result, the 2009 Reference Case Scenario is exhibiting some of the features of the Triple E scenario considered in the 2007 report[8].

[8] The Triple E scenario was one of the potential energy outcomes considered and in this scenario society was increasingly attempting to balance energy, environment and economic factors.

Chapter 3. Key Drivers

- This report considers three alternate price cases. The 2009 Reference Case Scenario reflects a moderate view of future energy prices collected through stakeholder consultations in early 2009. The NEB also considers cases where crude oil and natural gas prices are assumed to be either lower or higher. These alternate analyses are referred to as the Low Price Case and the High Price Case.

Energy Prices

Crude Oil Prices

- In the 2009 Reference Case Scenario, the WTI crude oil price is assumed to average roughly US$50/bbl in 2009. The price is assumed to increase with the recovering global economy, reaching US$90/bbl by 2020 (US$2008/bbl), compared to the 2007 Reference Case, which assumed constant crude oil prices averaging around US$50/bbl[9]. The 2009 price outlook is influenced by global energy demand and supply fundamentals that suggest an increasingly tight crude oil market in the long-term, supporting real growth in the oil price. Income and demand growth in emerging economies after 2009, along with the increasing difficulty and cost to develop crude oil pools are the major factors.

[9] Prices are reported in US$2008 unless otherwise specified.

- The WTI crude oil price in the Low Price Case reaches just above US$60/bbl in 2020 and the High Price Case grows to just over US$120/bbl.

Figure 3.1 - West Texas Intermediate Crude Oil Price at Cushing, Oklahoma, Reference Case Scenario and Price Cases

Natural Gas Prices

- After declining significantly in 2009, the Henry Hub price of natural gas in the 2009 Reference Case Scenario gradually rises from US$6.70/MMBtu in 2011 to US$7.50/MMBtu by 2020. These prices are slightly below the US$7.50/MMBtu assumed in the 2007 Reference Case[10], reflecting a greater availability of tight gas and shale gas supply.

[10] Specifically, $7.00 in $2005 US/MMBtu as prices were reported in 2005 dollars in the 2007 report.

- Natural gas prices are primarily determined on a continental basis as a result of the integrated nature of the North American natural gas demand and supply market, and import capacity and liquidity in the global liquefied natural gas (LNG) market. Traditionally, natural gas prices have moved in relation to crude oil prices, although usually at a slight discount to the 6:1 energy-equivalent basis, resulting in a natural gas to oil price ratio of roughly 10:1 (oil prices in $/barrel relative to natural gas prices in $/MMBtu). This relationship has not held over the last few years and there is uncertainty about the future price relationship.

- In the Low Price Case, the Henry Hub natural gas price rises from US$5.10/MMBtu in 2011 to US$5.50/MMBtu in 2020. In the High Price Case, the Henry Hub price rises from US$8.30/MMBtu in 2011 to US$11.00/MMBtu in 2020.

Figure 3.2 - Henry Hub Natural Gas Price at Louisiana, Reference Case Scenario and Price Cases

Electricity Prices

- Electricity prices are determined in regional markets. Consumer prices for electricity are composed of generation, transmission and distribution costs. Prices are lowest in the hydro-based provinces (British Columbia, Manitoba, and Quebec), which benefit from a high proportion of low-cost heritage assets, such as hydro-generating stations that are often many decades old and whose capital costs are largely amortised.

- Prices in most jurisdictions are based on the cost of providing service to consumers including a regulated rate of return on generation, transmission and distribution assets. Costs are approved by provincial and, in some cases, municipal regulators. When required, the cost of new generation, usually more expensive than heritage assets, must also be approved and rolled in, resulting in higher average costs.

- This model is followed in all provinces and the territories except Alberta and Ontario. In Alberta generation costs are based on competitive wholesale markets, while Ontario is a hybrid of the two methodologies, with a blend of heritage pricing for coal, nuclear and hydro plants and market-based prices for new generation.

- Typically, prices tend to be higher for residential customers and lower for large volume commercial and industrial customers, reflecting the cost of serving these markets. In addition, large customers may have access to power at lower costs than can be obtained from the provincial or municipal electric utility. This requires open access to transmission systems (or wholesale access). All provinces have some form of wholesale access.

- Similar to the 2007 Reference Case, electricity consumers continue to face upward pressure on electricity rates in the 2009 Reference Case Scenario. This is mainly driven by the development of higher-cost generation resources and planned improvements to transmission systems.

Coal Prices

- Canadian coal prices for power generation vary substantially by region, with prices in Western Canada being generally lower, reflecting the cost of integrated mining and power generation (mine mouth power plants). Prices of coal imported to Nova Scotia, New Brunswick and Ontario reflect the competitive international market. Western Canadian coal is not usually competitive in Ontario, after taking into account quality differences and transportation costs.

- In the period to 2020, coal prices are assumed to remain approximately constant at levels experienced in 2007. Competitive pressures and productivity increases in mining and rail transportation prevent coal prices from increasing with gradually rising oil and gas prices in the Reference Case Scenario. There is no assumption of an incremental carbon price in the Reference Case Scenario.

Economic Growth

- Economic projections are a key driver for the Reference Case Scenario projections. Macroeconomic variables including economic growth, gross output, inflation and exchange rates are used to develop the energy demand and supply outlooks.

- In the 2009 Reference Case Scenario, Canadian average real GDP growth is 2.1 per cent per year over the outlook period. Long-term economic growth is dependent on population, labour force and productivity assumptions. This rate of growth is slower than in the previous Reference Case Scenario outlook, reflecting more conservative assumptions for productivity growth rates (1.1 per cent versus 1.6 per cent).

- The current economic recession is reflected in this analysis. In 2009, economic growth is estimated to be -2.6 per cent. Growth is assumed to rebound to + 2.6 per cent in 2010. As in many past business cycles, the recession is assumed to be followed by rapid, recovery-stage growth. It then returns to trend growth expectations in 2013 consistent with the demographic and productivity assumptions in this analysis.

- Changes to commodity prices are expected to influence economic conditions in Canada as well as the exchange rate. In recent years, as global crude oil prices increased the Canadian dollar has appreciated compared to the U.S. dollar and as global crude oil prices decreased the Canadian dollar has depreciated.

- In the Low Price Case, consumer energy costs are lower, both directly (e.g., transportation fuels) and indirectly, for products which use energy as an input (e.g., transportation of goods to market, etc.). These lower costs encourage consumption. In addition, the manufacturing sector, concentrated in central Canada, faces lower input costs and enjoys more favourable trading terms because the exchange rate is assumed to depreciate with lower global crude oil prices. This helps spur economic growth in these sectors. Although consumers and industries in oil and gas producing provinces benefit from lower energy prices, overall economic growth is dampened due to lower energy prices, which reduce oil and gas production. The opposite effect tends to occur in the High Price Case.

- The net effect is a relatively small difference in economic growth at the national level. Canadian economic growth is projected to be 2.0 per cent and 2.3 per cent in the Low Price Case and High Price Case, respectively.

Key Uncertainties to the Outlook

- Future global crude oil prices continue to be a key uncertainty. Some of this risk has been tempered by examining a Low Price Case and High Price Case.

- There is an evolving natural gas and crude oil price relationship. Until mid-2007, natural gas prices in North America often moved within a band defined at the upper end by the price of distillate fuel oil, such as heating oil, and at the lower end by residual fuel oil, which is used to heat boilers in industrial and power generation applications.

- A key rationale given for this observed relationship was the ability of industrial and power generation facilities with dual fuel capability to readily switch between natural gas and residual fuel oil depending on which fuel had the lower price. Over the years, the amount of this dual-fuel capable capacity has eroded to relatively insignificant levels due to several factors including high maintenance costs, environmental restrictions and siting issues, raising the possibility that the observed relationship was becoming more of a behavioural artifact than a physical reality.

- Since mid-2007, natural gas prices have often tracked US$3.00 to $4.00/MMBtu below the residual fuel oil price, and closer to a delivered coal price to eastern power utilities, including allowances for emissions permits. Such behaviour has given rise to speculation that the lower boundary for natural gas prices has become the coal price, or effectively a "coal floor". The rationale for this view is the scale of the coal-fired generation fleet in the U.S., which is large enough[11] that even a minor displacement of coal units through the dispatching of natural gas-fired plants would create enough additional natural gas demand to keep natural gas prices from falling further.

[11] Roughly 1 billion short tons of coal are consumed in U.S. power generation per year (Energy information Administration) equivalent in energy content to at least 31 Tcf or 85 Bcf/day of natural gas. This is more than the roughly 70 Bcf/d combined total of U.S. and Canadian natural gas production.

- The growing contribution to natural gas supply from tight gas and shale gas is helping to reduce concerns of inadequate future supply and has the potential to expand the traditional discount that North American natural gas prices have received relative to world oil prices. The relative abundance of tight gas and shale gas could impact LNG imports, frontier projects, and exports from Canada to the U.S.

Reportedly, U.S. shale gas production can be economically produced at market prices in the US$3.50/MMBtu to US$4.00/MMBtu range. As the contribution of shale gas to overall production increases, more of the highest-cost conventional gas could be displaced, effectively shifting natural gas costs lower.

The relatively large scale of shale gas potential in North America may keep natural gas prices down. In contrast, there is a commonly held view that crude oil costs and prices may move higher. Upward influences on crude oil costs include increasing resource nationalism, increasing technical challenges associated with deep water and sub-salt prospects offshore, higher operational and environmental costs associated with oil sands developments, and demand growth for petroleum in developing countries. - Since the influence of these factors on natural gas prices is unclear at this point, the approach taken in this analysis is to plot an independent course for natural gas prices based on North American market fundamentals such as cost, supply and demand. Should price relationships with other fuels become more apparent at a future time, these can be adopted in future versions of this analysis.

- The current economic uncertainty also poses a risk to the 2009 Reference Case Scenario. The length and depth of the current Canadian and global economic recession are unknown, as is the pace of economic recovery. If these factors evolve differently than assumed here it will influence energy markets and the reference case projections.

- Over the outlook period, there are likely to be significant unpredictable events beyond the realm of normal expectations, such as technological breakthroughs. These unforeseeable events are not included in this analysis.

Chapter 4. Energy Demand Outlook

- Total secondary (end-use) energy demand in Canada is expected to increase with increases in population and economic growth (Figure 4.1). However, energy demand growth rates are projected to slow compared to history and compared to the NEB's 2007 projection (Figure 4.2). End-use energy demand is estimated to increase at 0.7 per cent per year. This is primarily due to slower economic growth assumptions in the 2009 Reference Case Scenario.

Figure 4.1 - Canadian Total Secondary Energy Demand, Reference Case Scenario and Price Cases

Figure 4.2 - Comparison of 2009 Reference Case Scenario and 2007 Reference Case End-Use Demand

- Another important factor contributing to lower energy demand expectations are newly included provincial and federal energy demand management and environmental programs. This includes stricter building code requirements in various provinces, new minimum energy efficiency standards for energy using equipment, new standby limits on common household items and phase-out of inefficient lighting in Canada.

- Greenhouse gas emissions from energy are a function of energy supply and demand decisions. As demand continues to increase, GHG emissions are expected to increase as well. However, the slowing growth in energy demand as a result of these newly included programs will result in slowing growth in GHG emissions. Further, as the environmental policies mentioned earlier take shape as programs, this growth rate will decrease further. Observed trends in energy supply, including use of greener fuels in electricity, will also result in a decline in the growth rate of GHG emissions. These combined trends as depicted in the 2009 Reference Case Scenario are expected to slow the growth in GHGs as compared to both history as well as NEB's 2007 projections.

- Historically, Canadian energy intensity, which is the amount of energy used per dollar of GDP generated, has fallen. This measure provides an indication that Canada is using energy more efficiently over time. Energy intensity continues to fall over the outlook period, with an average annual reduction of 1.3 per cent per year.

- Changes to energy prices and economic growth impact end-use energy demand. In the Low Price Case, the annual average end-use energy demand growth rate is 1.2 per cent per year (Figure 4.1). On the other hand, annual average end-use energy demand for Canada in the High Price Case is reduced to 0.3 per cent per year. Higher energy prices provide the impetus to consumers to reduce energy consumption. The opposite effect occurs in the Low Price Case.

- As discussed in the Key Drivers chapter, higher energy prices also impact Canadian economic conditions. This in turn influences energy demand trends. In the Low Price Case, economic growth is stronger in central Canada as a result of more favourable energy input costs and trading conditions compared to the oil and gas producing provinces. As a result, central Canadian energy demand grows stronger in the Low Price Case than in the other cases considered. The opposite effect generally occurs in the High Price Case where economic development and therefore energy demand is spurred by higher energy prices in oil and gas producing provinces.

Energy Consumption by Sector[12]

[12] Note that the 2009 outlook for energy demand growth by sectors is not directly comparable to the 2007 Energy Future's Reference Case outlook due to changes in sector definitions. These changes were motivated by a desire to align various energy demand data sets in Canada. The difference in total historic end-use demand is less than one per cent in any given year but sectoral differences are larger.

Residential Sector

- The residential sector accounts for energy consumed by Canadian households, including energy for space and water heating, air conditioning, appliances and other end-use energy devices (e.g., televisions, computers, etc.).

- In the year 2007, Canadian residential energy demand was 1 448 PJ and accounted for about 14 per cent of total end-use energy demand. Over the outlook period, residential sector energy demand grows at an average rate of 0.5 per cent per year reaching 1 552 PJ by 2020. The fuel mix of residential demand changes little over the outlook period.

- The rate of growth in residential sector energy demand in the 2009 Reference Case Scenario is slower than in the 2007 Reference Case and historic data due to slowing economic conditions. Residential energy demand growth also slows as a result of government policies and changing consumer values.

- Programs included in the 2009 Reference Case Scenario that were not included in the 2007 Reference Case consist of stricter building code standards in British Columbia, Ontario and Quebec. New furnace and boiler efficiency standards improve the energy intensity of all new homes nationally. Also, a new standard to phase out inefficient lighting starting in 2012 has been applied across Canada. The number of home electronic goods that were formerly unregulated, and are now under minimum energy performance guidelines, has increased. In addition, many of these home electronics begin to come into the market with new standby power restrictions, which can significantly reduce unit energy demand. The analysis also considers the impact of complimentary programs such as energy retrofit, rating and labeling initiatives, purchasing incentive programs, conservation promotion and on-site renewable energy. The ecoENERGY initiative for solar thermal and geothermal energy has partners in several provinces. In addition, many regions now have provisions in place that allow small, renewable energy systems to connect to the provincial grid.

- Natural gas and electricity make up the majority of demand in this sector (Figure 4.3). Impressive improvements in energy efficiency in the residential sector for space heating and major appliances have been countered by increased energy demand from increasing home size, preferences for air conditioning, and more electronic goods. These factors are evident in the historical trend showing ever-increasing consumption per household, particularly electricity demand. Over the outlook period, electricity demand growth is projected to slow from historic trends but it still remains the fastest growing energy source in the residential sector influenced primarily by continued growth in electronic goods. Policies specifically addressing a couple of rampant growth categories (e.g., standby power), along with consumer purchasing decisions, impact the historical trend.

Figure 4.3 - Residential Sector Energy Demand by Fuel, Reference Case Scenario

- Regional availability of fuel, energy prices, and end-use demand determines the mix of fuel used across Canada. In Atlantic Canada, residential demand has been met with electricity, oil and biomass as natural gas was historically unavailable. Hydro-rich provinces, such as Quebec, Manitoba, and British Columbia, rely more heavily on electricity to meet residential energy demand than other provinces, as electricity prices tend to be competitive with other fuels. Similarly, Alberta and Saskatchewan rely more heavily on natural gas than other regions as there is an abundant supply of this fuel in the region.

- In recent years, expanding natural gas infrastructure in Nova Scotia and New Brunswick has allowed natural gas to penetrate residential, commercial and industrial sectors. This is expected to continue in the future. In the residential sector, natural gas demand is projected to account for two per cent of Nova Scotia residential demand and three per cent of New Brunswick demand by 2020.

- In the Low Price Case, average residential energy demand growth increases to 0.7 per cent per year. In the High Price Case, average residential energy demand growth falls to 0.3 per cent per year.

Commercial Sector

- The commercial sector is a broad category that includes offices, retail, warehousing, government and institutional buildings, utilities, communications, and other service industries. It also includes energy consumed by oil and gas pipelines and street lighting. Generally, end-uses are similar to the residential sector and include space heating and cooling, water heating, lighting, and electrical plug-load.

- In the year 2007, Canadian commercial energy demand was 1 471 PJ and accounted for about 14 per cent of total end-use energy demand. Over the outlook period, commercial sector energy demand grows at an average rate of 1.4 per cent per year, reaching 1 769 PJ by 2020 (Figure 4.4). The share of commercial demand increases slightly to 15 per cent of total end-use energy demand over the outlook period.

Figure 4.4 - Commercial Sector Energy Demand by Fuel, Reference Case Scenario

- Overall, growth in this sector is slightly higher than in the 2007 Reference Case due to a stronger emphasis on service sector growth compared to the goods producing sector in the macroeconomic outlook. However, this rate of growth in the commercial sector is slower than its historical rate. As with the residential sector, a combination of factors converge to support a more aggressive improvement in energy efficiency than in the past, including ongoing higher prices and government initiatives.

- Energy-related policies in the 2009 Reference Case Scenario that were not in the 2007 Reference Case include new provincial building codes in several provinces addressing energy consumption in commercial buildings. These codes are primarily related to insulation and heating/ventilation and air conditioning minimum standards and call for a 25 per cent improvement in energy demand over the Model National Energy Code for Buildings (1997) level. British Columbia has endorsed one of the most aggressive commercial building standards in North America.

- All provinces would see, as a minimum, gains from the updated federal equipment standards, including minimum boiler efficiency and packaged heating/cooling units as well as improvements in lighting efficiency. In addition, federal and provincial programs for commercial building retrofits are assumed to stay in place for the full Reference Case Scenario period.

- In the Low Price Case, average commercial energy demand growth increases to 1.6 per cent per year. In the High Price Case, average commercial energy demand growth falls to 1.2 per cent per year.

Industrial Sector

- The industrial sector includes manufacturing, forestry, fisheries, agriculture, construction, and mining. The majority of industrial energy demand is found in a handful of energy-intensive industries, such as iron and steel, aluminium manufacturing, cement manufacturing, chemicals and fertilizers, pulp and paper, petroleum refining, and oil and gas extraction[13].

[13] In 2007, energy-intensive industries accounted for about 80 per cent of industrial energy demand. Industries outside of energy-intensive industries, such as light manufacturing, agriculture, forestry and construction, each account for a relatively small proportion of industrial energy demand, but taken together account for about 20 per cent.

- The industrial sector makes up the largest share of the energy use in Canada accounting for about 48 per cent of energy demand in 2007. By 2020, the industrial share decreases to 46 per cent reflecting slowing economic growth in the Canadian goods producing sector. Overall, industrial sector growth is slow over the Reference Case outlook reaching 5 381 PJ in 2020 (Figure 4.5).

Figure 4.5 - Industrial Sector Energy Demand by Fuel, Reference Case Scenario

- Energy-intensive industries in Canada are mature industries, facing increasing global competition and higher Canadian exchange rates. An exception to the overall industrial energy demand trend is the oil and gas industry. The strength of this industry drives much of the industrial sector energy demand growth over the outlook. Oil sands operations are energy-intensive, requiring significant amounts of natural gas, as well as other fuels, such as refined petroleum products, still gas, petroleum coke and electricity.

- Over the past decade, the energy efficiency in oil sands operations has improved on the order of one per cent annually. In the Reference Case Scenario, this rate of improvement is applied to the natural gas requirements to the year 2020. In addition, the adoption of alternative fuels and processes are considered, such as bitumen gasification as well as the application of THAITM in situ recovery process and solvents to reduce thermal energy requirements.

- In the Reference Case Scenario, total purchased natural gas requirements for oil sands, excluding on-site electricity requirements, increase from 245 PJ to 537 PJ by 2020[14].

[14] In terms of volume, this equates to an increase from 17 million m³/d (0.6 Bcf/d) in 2007 to 40 million m³/d (1.4 Bcf/d) in 2020.

- A key challenge in forecasting energy demand change in the industrial sector arises from the extent and direction of environmental legislation. At the time of this report preparation, there was gaining momentum in North America for a market system for GHG emissions reductions, specifically a cap-and-trade program. Impending decisions by government and industry are likely to impact the amount and type of energy used by the Canadian industrial sector. However, legislation is still evolving and therefore potential impacts from any future decisions in this area are not considered in the 2009 Reference Case Scenario.

- In the Low Price Case, average industrial energy demand growth is 0.6 per cent per year. In the High Price Case, average industrial energy demand growth falls to -0.1 per cent per year.

Transportation Sector

- Transportation sector demand includes passenger, freight and off-road transportation for on-road vehicles as well as air, rail and marine travel. Total transportation energy demand accounts for 24 per cent of end-use energy demand in 2007 and changes marginally over the outlook period.

- Transportation sector energy demand is projected to increase by an average of 1.2 per cent per year. Similar to the other sectors examined, the 2009 Reference Case Scenario for transportation sector energy demand is slower compared to historic growth rates as well as the 2007 Reference Case projection. This result is due to higher fuel prices, slowing economic conditions, more rapid uptake of energy-efficient technology, such as hybrid electric vehicles, as well as changes to consumer behaviour and purchasing decisions.

- Passenger transportation comprising on-road vehicles, transit, and air travel continues to be the largest component of Canadian transportation energy demand accounting for 55 per cent and 52 per cent of transportation demand in 2007 and 2020, respectively (Figure 4.6). Freight transportation demand includes on-road trucking, rail, marine and some air and is expected to continue to grow more rapidly than passenger transportation demand over the outlook period, averaging 1.8 per cent per year. Off-road transportation demand is defined as all-terrain vehicles, lawnmowers, and miscellaneous small equipment and accounts for less than five per cent of transportation energy demand.

Figure 4.6 - Transportation Sector Energy Demand by Mode, Reference Case Scenario

- The transportation sector is dominated by refined petroleum products, primarily gasoline and diesel fuel (Figure 4.7). Refined petroleum products continue to meet the majority of energy demand requirements in the transportation sector. With the exception of ethanol, supported by provincial fuel standards in Saskatchewan, Manitoba and Ontario, the market share of alternative fuels (e.g., propane, natural gas and electricity) remains static in this outlook.

Figure 4.7 - Transportation Sector Energy Demand by Fuel, Reference Case Scenario

- There is tremendous interest in hybrid electric vehicles, plug-in hybrid electric vehicles, and full electric vehicles. In the Reference Case Scenario, hybrid vehicles continue to penetrate the transportation market and improve passenger transportation energy demand intensity by slowing gasoline consumption. However, they do not influence the electric demand outlook in the transportation sector as hybrid vehicles have a self-contained battery and engine system and do not use grid power.

- The potential for alternative vehicle technologies to make significant in-roads into the transportation sector depends largely on the economics, consumer preferences and rates of vehicle turnover. Although attitudes can change rapidly, it takes time for new technologies to permeate the market. It is assumed that even with increases in market penetration, the share of plug-in hybrid and full electric vehicles in the total vehicle market in 2020 would not significantly alter the sector's fuel mix.

- It is important to note that it is a dynamic time for the automotive sector in North America. At the time of writing, the automotive industry is in a state of significant change as a result of the global economic recession. Coinciding with the changes in the industry itself are developments in government policy that could reshape transportation sector energy demand. Proposals for more stringent fuel efficiency standards on motor vehicles have been proposed at the U.S. federal level and also at the state level. The Canadian federal government and a number of provinces in Canada have also announced their intent to regulate fuel consumption of motor vehicles. It is possible that Canada's regulations will align with the U.S. federal and/or California State regulations given the highly integrated nature of the North American automotive industry.

- In addition, legislation to reduce the carbon intensity of transportation fuels and to advance alternative fuels for the transportation sector are being developed in California. This policy is also examined at the national level in the U.S. and at the provincial level in Canada. Both the Ontario and British Columbia governments have indicated that they will adopt California's Low Carbon Fuel Standard.

- Sufficient details on the future of vehicle fuel economy standards and the low carbon fuel intensity standards for Canada are not available to quantify for the 2009 Reference Case Scenario. However, the expectation is that these standards could lead to improved average fuel economy of the vehicle fleet in Canada and changes to the vehicle fuel mix. This is a rapidly evolving area. These programs will be included in future analysis as details become available.

- In the Low Price Case, average transportation energy demand growth increases to 2.1 per cent per year. In the High Price Case, average transportation energy demand falls to 0.6 per cent per year.

Key Uncertainties to the Outlook

- One of the biggest challenges of this report period is the implementation of several key polices at the federal level that are not yet final. Although in the development stage, they are lacking in sufficient detail to be properly modeled in the Reference Case Scenario.

- However, the expectations are that these policies will influence the absolute level of energy demand as well as the fuel mix. Changes in the absolute level of energy demand will depend on the sector and sub-sectors considered. Policies designed to improve energy efficiency, such as vehicle efficiency standards, will reduce energy demand. However, the full benefit of these improvements in energy efficiency might not materialize as a result of the rebound effect. The rebound effect means the tendency for consumers to increase utilization of energy using devices when efficiency improves due to reduced operational costs (e.g., increase travel due to improved vehicle efficiency). On the other hand, technological solutions to reduce GHG emissions, such as CCS, can increase energy demand requirements concurrently with reduction of GHG emissions as additional resources are required to capture, transport and store CO2.

- There is very little fuel switching projected over the outlook period in the 2009 Reference Case Scenario. Changes in fuel demand are slow to occur, in large part due to the large stock of existing energy using devices in the economy. However, upcoming legislation could encourage faster development and/or adoption of alternative and renewable fuels resulting in higher consumption of these fuels and reduced demand for more conventional fuels than presented in this analysis.

Chapter 5. Crude Oil Supply Outlook

Resources

- Canada is endowed with vast oil resources. These resource numbers are dominated by bitumen resources, which account for 98 per cent of total remaining crude oil reserves. The Alberta Energy Conservation Board reports remaining reserves of crude bitumen of 27.5 billion cubic metres (172.9 billion barrels), at year-end 2007. Crude bitumen deposits also exist in the province of Saskatchewan, and are in the early stages of delineation, but no official resource estimates are yet available.

- In the Western Canada Sedimentary Basin (WCSB), including Norman Wells and Cameron Hills in the Northwest Territories, remaining reserves of conventional crude oil amount to 451.6 million cubic metres (2.85 billion barrels)

- Statistics for Eastern Canada are dominated by the Newfoundland and Labrador Offshore, with remaining reserves of 161.2 million cubic metres (1.02 billion barrels)

- A detailed breakdown of Canada's remaining crude oil reserves is provided in Appendix 3.

Crude Oil Supply Outlook

- Figure 5.1 illustrates the oil production outlook for all of Canada, for all types of crude. Figure 5.2 shows a comparison between the 2007 Reference Case and the 2009 Reference Case Scenario. The difference between the projections is indicative of the impact of the current economic conditions, which decreased global crude oil demand and energy prices thereby reducing the economics of Canadian production. The gap widens to 125 thousand m³/d (790 Mb/d) by 2015, primarily due to lower projected oil sands production, but also due to shifting the onset of the Hebron Field, situated in the Newfoundland and Labrador offshore region, from 2013 to 2017. This latter date reflects the project proponents' decision to proceed, after extended negotiations with the province. The gap narrows to 40 thousand m³/d (250 Mb/d) by 2020 as growth accelerates in the latter part of the projection. By 2020, production reaches 608 thousand m³/d (3.8 million b/d).

Figure 5.1 - Total Canadian Oil Production, Reference Case Scenario

Figure 5.2 - Comparison of 2009 Reference Case Scenario and 2007 Reference Case Crude Oil Supply Outlook

- WCSB conventional oil production continues a well-established historical decline of about three per cent per year, consistent with a maturely developed basin. In the near-term, for 2009 and 2010, sharply lower oil prices than experienced in the first half of 2008 and the corresponding reduced drilling effort serve to decrease oil production levels. However, this effect has been moderated by the success of the Bakken play, and the Weyburn and Midale CO2 Enhanced Oil Recovery (EOR) projects in southeast Saskatchewan.

- As well, it is assumed that initiatives by the provincial and federal governments to promote CCS will lead to the construction of facilities, including CO2 pipelines, which will make available additional quantities of CO2 in the latter part of the forecast. Some 16 million m³ (100 million barrels) of EOR recovery is added over the projection period related to this additional source of CO2. By 2020, conventional production declines to 111 thousand m³/d (700 Mb/d), about 14 thousand m³/d (90 Mb/d) above the 2007 Reference Case projection.

- For Eastern Canada, the three major producing fields offshore Newfoundland and Labrador are in decline, but this decline is moderated by the addition of several satellite fields, starting in 2010, as well as the larger Hebron field in 2017. In the 2009 Reference Case Scenario, production declines to 33.6 thousand m³/d (212 Mb/d) in 2020.

- The assumption that a large field, of 80 million m³ (500-million barrel) size, will be discovered and be in production by 2019, is no longer included in the Reference Case Scenario, and is applied only in the High Price Case. This would result in Eastern Canada production of 57.2 thousand m³/d (360 Mb/d) by 2020.

- Rapidly escalating capital costs to build oil sands projects, followed by the global economic downturn and freeze-up of credit markets, led to the postponement of numerous planned oil sands projects by the end of 2008. Those projects that were already well underway and scheduled to be completed in 2009 and 2010 are expected to be completed, but most other projects will be delayed until economics improve. The production projection is expected to flatten somewhat after 2010. Growth rates increase after the 2014 to 2015 timeframe, in conjunction with improving oil prices. Compared to the 2007 Reference Case, this projection has oil sands production lower by 108 thousand m³/d (680 Mb/d) by 2015. By 2020, this gap is reduced to 80 thousand m³/d (504 Mb/d) and total oil sands production is 445 thousand m³/d (2.8 million b/d) (Figure 5.3).

Figure 5.3 - Oil Sands Production, Reference Case Scenario

- Many of the project postponements announced in the last year involved upgraders, which convert bitumen into synthetic crude oil, either stand-alone third party "merchant upgraders", or part of integrated mining and upgrading projects. These delays mean that a larger proportion of the oil sands production will not be upgraded in Alberta. By 2020 about 54 per cent of bitumen will be upgraded in Alberta, compared to 65 per cent in the 2007 forecast.

- As levels of non-upgraded bitumen increase, so does the need for diluent, predominantly condensate, for blending purposes. The requirement for imported diluent is estimated to be in the order of 40 to 50 thousand m³/d (250 to 300 Mb/d) by 2020. Currently, about 10 thousand m³/d (63 Mb/d) is being imported via the west coast, and by truck and tank car from the U.S. The Southern Lights pipeline, scheduled to be in operation by 2010, has capacity of 28.6 thousand m³/d (180 Mb/d), with the capability of adding capacity when required.

- The estimates of initial capital expenditures required to build new projects and threshold prices needed to justify construction of greenfield projects assume a 30 per cent decline from last year's highs in most input costs, including material and labour.

- Estimates suggest that integrated mining and upgrading projects would cost in the order of US$80,000 to $100,000/bbl of capacity to build with an oil price of $60 to $70/bbl required to make a greenfield project economic (Table 5.1). For projects which produce non-upgraded bitumen, steam-assisted gravity drainage and cyclic steam stimulation projects, corresponding estimates would be US$30,000 to $40,000/bbl and a WTI price of $US55 to $65/bbl as a threshold price. These estimates include a 10 per cent real rate of return on investment to the project owners.

Table 5.1 - Estimated Initial Capital Expenditure and Threshold Prices for New Oil Sands Projects

| CAPEX ($C / bbl of capacity) |

Economic Threshold (WTI US$/bbl) |

|

|---|---|---|

| Mining Extraction & Upgrading | $80,000-$100,000 | $60-$70 |

| SAGD / CSS | $30,000-$40,000 | $55-$65 |

- The light/heavy differential is assumed to moderate from the 2007 Reference Case Scenario estimate, indicated by the improved demand outlook for heavy crude oil, and the weaker market outlook for synthetic crude oil in the medium term.

- In the High Price Case, production growth outpaces Reference Case Scenario growth after 2012, and is about 10 per cent greater by 2020 (Figure 5.4). This gap would be larger except for the assumption that as the oil price escalates, the operating and capital expenditure costs rise proportionately.

Figure 5.4 - Oil Production, Reference Case Scenario and Price Cases

- In the Low Price Case, slight growth occurs in the near-term related to limited capacity expansion for established oil sands projects. Some growth resumes late in the forecast as industry adjusts to lower prices.

- At the lower price, production reaches 460 thousand m³/d (2.9 MMb/d) by 2020, compared with 695 thousand m³/d (4.4 MMb/d) at the high price.

Supply and Demand Balances

- Required crude oil feedstock for refining is a function of petroleum product demand. The oil refining sector in Canada relies on both domestic and imported crude to produce products Canadians demand. Canada also imports products as it is economic to do so in some regions.

- From 2008 to 2020, total Canadian refinery feedstock requirements rise by 14 per cent to 349 000 m³/d (2.2 MMb/d) in the Reference Case Scenario.

- In the High Price Case, product demand is lower, so feedstock requirements rise by only nine per cent to 333 000 m³/d (2.1 MMb/d). In the Low Price Case, where product demand is greater, requirements rise by 21 per cent to 363 000 m³/d (2.3 MMb/d).

- Exports of Canadian crude oil have been rising and will continue to respond to increases in supply from Alberta's oil sands and decreases in supply from conventional sources. Exports are surplus to domestic demand and respond directly to increases or decreases in supply.

- In the Reference Case Scenario from 2008 to 2020, exports rise 60 per cent to 447 000 m³/d (2.8 MMb/d). Both light and heavy crude register similar percentage increases in exports over the period 2008 to 2020 (Figure 5.5 and Figure 5.6). In comparison to the 2007 report, the total export volume decreases by two per cent from 455 000 m³/d (2.9 MMb/d) reflecting a lower production outlook.

Figure 5.5 - Light Crude Oil Balance, Reference Case Scenario

Figure 5.6 - Heavy Crude Oil Balance, Reference Case Scenario

- In the High Price Case, total exports rise by 90 per cent to 545 000 m³/d (3.4 MMb/d). The higher export volume reflects an increase in supply with prices stimulating development.

- In the Low Price Case, development decreases, resulting in lower overall Canadian supply. This is reflected in lower export volumes. In 2020 exports are 281 000 m³/d (1.8 MMb/d).

Key Uncertainties to the Outlook

- Two key areas of uncertainty that will influence the oil supply outlook presented in this analysis are economic factors and future environmental policies.

- Current under-investment in oil supply projects may lead to an oil price spike with the global economic recovery. Increased volatility of oil prices makes investment decisions to expand production more challenging.

- Construction costs might not decline as assumed, or could escalate quickly as the economy recovers. The cost of building oil sands projects is influenced to a large degree by the demand for construction materials and labour on a global basis. A robust recovery of the global economy could lead to cost inflation that could dampen the pace of oil sands expansion.

- Most of the planned bitumen upgrading projects in Alberta have been postponed. Although the Alberta government is promoting upgrading within Alberta, and has several initiatives in place, including taking bitumen-in-kind in lieu of royalty, it is difficult to predict the level of local upgrading that will actually be put in place.

- Environmental compliance may add significant additional costs for oil sands developers, and dampen production growth. Although the Alberta government has clarified regulations regarding tailings ponds and their reclamation, and some aspects of water usage and air emissions, and the federal government has clarified some aspects of its regulations regarding oil sands development, the total costs of environmental compliance are still not well defined. Both Canada and the U.S. are developing a cap-and-trade system to reduce carbon emissions and are promoting CCS. The recent adoption of Low Carbon Fuel Standards in the state of California targeting oil with a higher carbon footprint, and the potential for other states to adopt similar measures, may have implications for oil sands exports to the U.S.

- The projected growth in oil sands output assumes additional volumes of synthetic crude oil and blended bitumen can be marketed in the U.S. and potentially Asia, and that the required pipeline capacity is built in a timely manner to accommodate these markets. While these assumptions appear reasonable, they are not certainties.

Chapter 6. Natural Gas Supply Outlook

Resources

- Canada has large amounts of remaining natural gas. In the 2009 Reference Case Scenario, Canada's remaining marketable natural gas resource base is estimated at 12 424 109m³ (439 Tcf).

- Tight gas is almost a third of the remaining resource base and is expected to be the source of almost 40 per cent of projected Canadian natural gas production through 2020. In this analysis, tight gas refers to a subset of the conventional gas category that is produced from low permeability reservoirs[15]. Tight gas reservoirs will typically not have sufficient natural pathways through the rock for natural gas to successfully flow to the wellbore and therefore require some form of artificial stimulation to create these pathways. At present, tight gas in Canada is not generally defined, nor is it typically distinguished from conventional gas as in the U.S.

[15] The areas of tight gas recognized in this study include: certain Cretaceous zones in the Deep Basin; the Milk River, Medicine Hat and Second White Specks formations in southeast Alberta and southwest Saskatchewan; the Jean Marie group in northeast B.C.; and the Montney region in northeast B.C.

- Western Canada also contains significant unconventional natural gas resources, including coalbed methane (CBM) and shale gas. These unconventional natural gas resources comprise 1 841 109 m³ (65 Tcf) or 15 per cent of estimated remaining natural gas resources.

- Other natural gas resources located north of the 60th parallel or offshore are designated as frontier supply. Frontier resource areas are estimated to contain 6 374 109m³ (225 Tcf) or 53 per cent of Canada's remaining marketable natural gas resources, but due to the long lead times for frontier projects only minor amounts are likely to be accessible by 2020.

Canadian Natural Gas Production Outlook

Drilling

- Natural gas production is linked to drilling activity. Across all three cases, a severe drilling pullback is projected to occur in Western Canada in 2009 in response to lower prices and an oversupplied North American market. Gas drilling drops from 11 000 wells in 2008 to between 4 500 and 7 500 wells in 2009, with the Reference Case Scenario estimate at 5 900 wells (Figure 6.1).

Figure 6.1 - Projected Natural Gas Wells Drilled, Reference Case Scenario and Price Cases

- In the 2009 Reference Case Scenario, prices in the US$7.00 to $7.50/MMBtu range would be sufficient to maintain a very gradual drilling decline in Canada from roughly 12 000 gas wells in 2013 to 9 200 by 2020. Rising shale and tight gas output in Canada would partially offset declines in conventional gas and be supplemented by frontier gas from northern Canada and off the east coast later in the projection.

- In the Low Price Case, higher cost unconventional and frontier projects in Canada would not be competitive, resulting in falling drilling rates yielding lower production and net exports. In the Low Price Case drilling remains around 5 000 wells for most of the projection and then slips lower toward the end of the period.

- In the High Price Case, drilling activity would rise and lead to greater Canadian natural gas supply. In the High Price Case, gas drilling reaches over 15 000 wells by 2012 and then declines very slowly. These levels of annual drilling are below those in the 2007 Reference Case that averaged about 18 000 natural gas wells annually. The key difference in the current cases is a greater reliance on a smaller number of more prolific wells in tight gas and shale gas areas. Projections of natural gas wells drilled are in Figure 6.1.

Production

- In the 2009 Reference Case Scenario, natural gas production is projected to decline in 2009 and 2010 due to reduced drilling. By the end of the outlook period, Reference Case Scenario production reaches 450 million m³/d (15.8 Bcf/d) (Figure 6.2). This is slightly higher than the 2007 Reference Case, which projected natural gas production to be 381 million m³/d (13.4 Bcf/d) in 2020 (Figure 6.3).

Figure 6.2 - Canadian Natural Gas Production, Reference Case Scenario

Figure 6.3 - Comparison of 2009 Reference Case Scenario and 2007 Reference Case Natural Gas Supply Outlook

- The biggest change to North American natural gas markets since the 2007 report is the potential for significant increases in tight gas and shale gas production. The production of tight gas and shale gas in the 2007 Reference Case was considerably lower at only 42 million m³/d (1.5 Bcf/d) by 2020. The change is largely related to technology improvements in horizontal drilling and hydraulic fracturing. This development is progressing rapidly in the U.S. and is beginning to get underway in Canada. Relative to major U.S. shale regions, the development of Horn River shale gas in northeast B.C. may be disadvantaged by its remote muskeg location. This could result in higher delivery costs for equipment and materials, higher costs for pipeline transportation, and access challenges to operate year round and not be confined to winter months when the ground is sufficiently frozen to allow the movement of heavy equipment. These disadvantages are potentially offset by the considerable thickness of the shale in northeast B.C. and their potential to hold higher quantities of gas-in-place than many of the U.S. shale areas.[16]

[16] In terms of estimated full cycle supply costs, Tristone Capital Inc. analysis puts Montney shale gas among the lowest of the major North American shale gas plays at US$4.50/MMBtu and the Horn River among the highest at US$7.50/MMBtu. (Tristone Capital Inc., Can You Smell What the Rocks are Cookin' - A 260 Tcf Shale Gas Revolution, October 6, 2008.).

- Montney tight gas and Horn River shale gas in northeast B.C., is expected to play an increasingly important role in the Reference Case Scenario, partially offsetting conventional declines after 2011[17]. In 2020, tight gas and shale gas account for 220 million m³/d (7.8 Bcf/d) of Canadian supply as compared to about 140 million m³/d (5 Bcf/d) in 2008. This includes an estimated 1.13 million m³/d (0.04 Bcf/d) of shale gas production in Quebec. The conventional gas production (including solution gas but excluding tight gas) in Western Canada declines by more than half between 2007 and 2020 from 320 million m³/d (11.3 Bcf/d) to 150 million m³/d (5.3 Bcf/d). Conventional gas production accounted for almost two-thirds of total production in 2007 and its contribution slips to just one-third of total Canadian production by 2020.

[17] These assumptions are in no way suggestive of the outcome of regulatory proceedings currently underway or expected in the future.

- CBM production in Western Canada is projected to rise by almost 50 per cent between 2007 and 2016 in the Reference Case Scenario to reach almost 28 million m³/d (1.0 Bcf/d). This would include significant development of Mannville CBM to supplement the Horseshoe Canyon production that currently dominates CBM output.

- The Reference Case Scenario sees Atlantic Canada production decline at the Sable Offshore Energy Project, with production offset in late 2010 by initial flows from the nearby Deep Panuke project. In the longer term, natural gas that is produced in conjunction with offshore Newfoundland oil projects (gas that is currently re-injected to maintain reservoir pressure), will become available. This can be delivered to markets by tankers configured to carry compressed natural gas (CNG), LNG or possibly pipelines. Natural gas operation is projected to begin in 2017, although this could be delayed by continued discovery of satellite oil pools.

- Considerations for northern projects include competition from shale gas, extreme market price volatility, labour availability, cost escalation, acquiring adequate financing, and obtaining land access. Based on these considerations, the 2009 Reference Case Scenario assumes that production of Mackenzie Delta natural gas would commence in 2017. This projection represents a delay of roughly two years from the 2007 Reference Case. This project is subject to the outcome of a regulatory process currently underway and any subsequent commercial decision to proceed. These assumptions are in no way suggestive of the outcome of the regulatory process currently underway. Alaskan gas is not included in the projections to 2020.

- In the Low Price Case, Canadian natural gas production falls to 280 million m³/d (9.9 Bcf/d) and in the High Price Case it increases to 595 million m³/d (21.0 Bcf/d) (Figure 6.4).

Figure 6.4 - Canadian Natural Gas Production, Reference Case Scenario and Price Cases