http://tweb7.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2020/net-zero/index.htmlResults

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

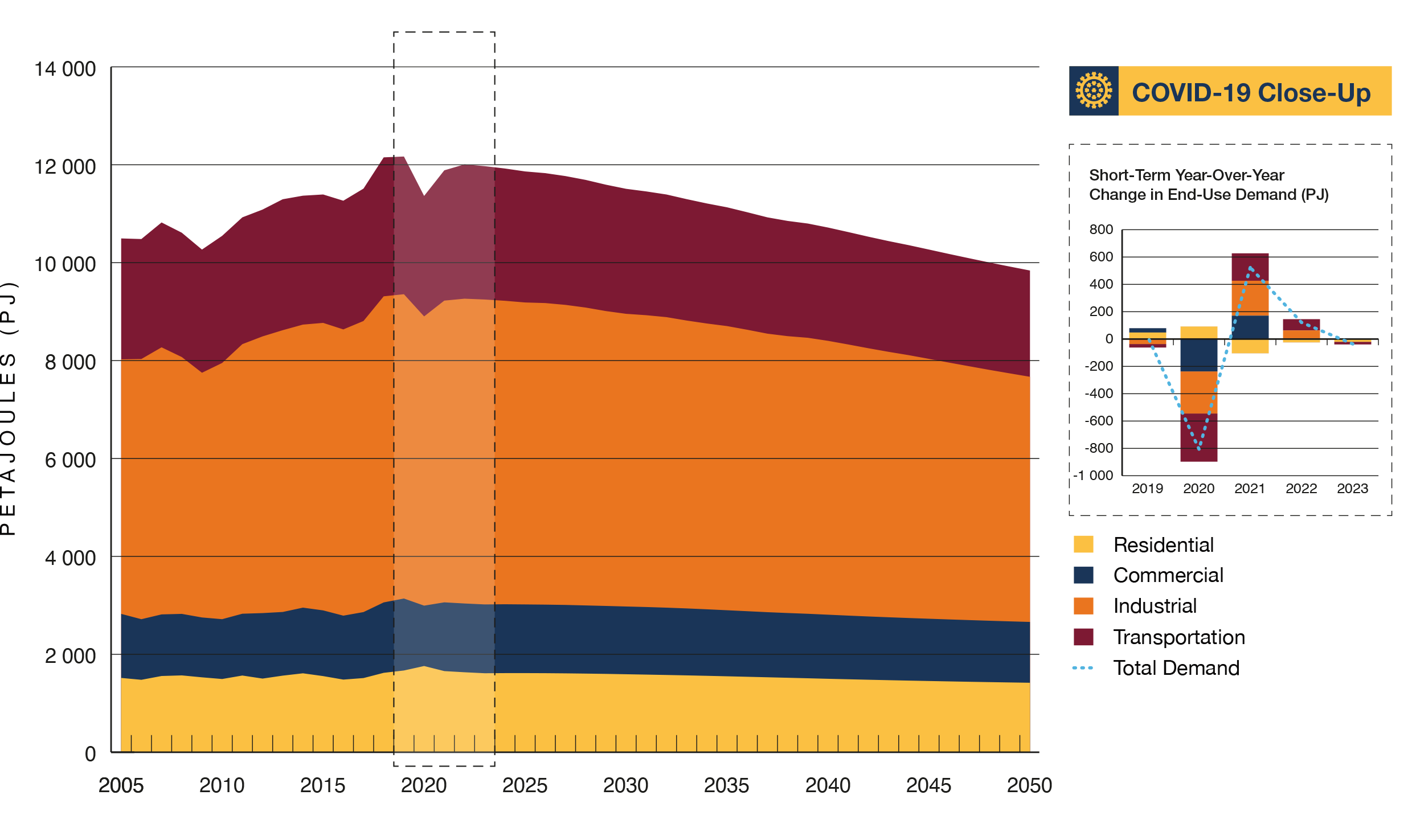

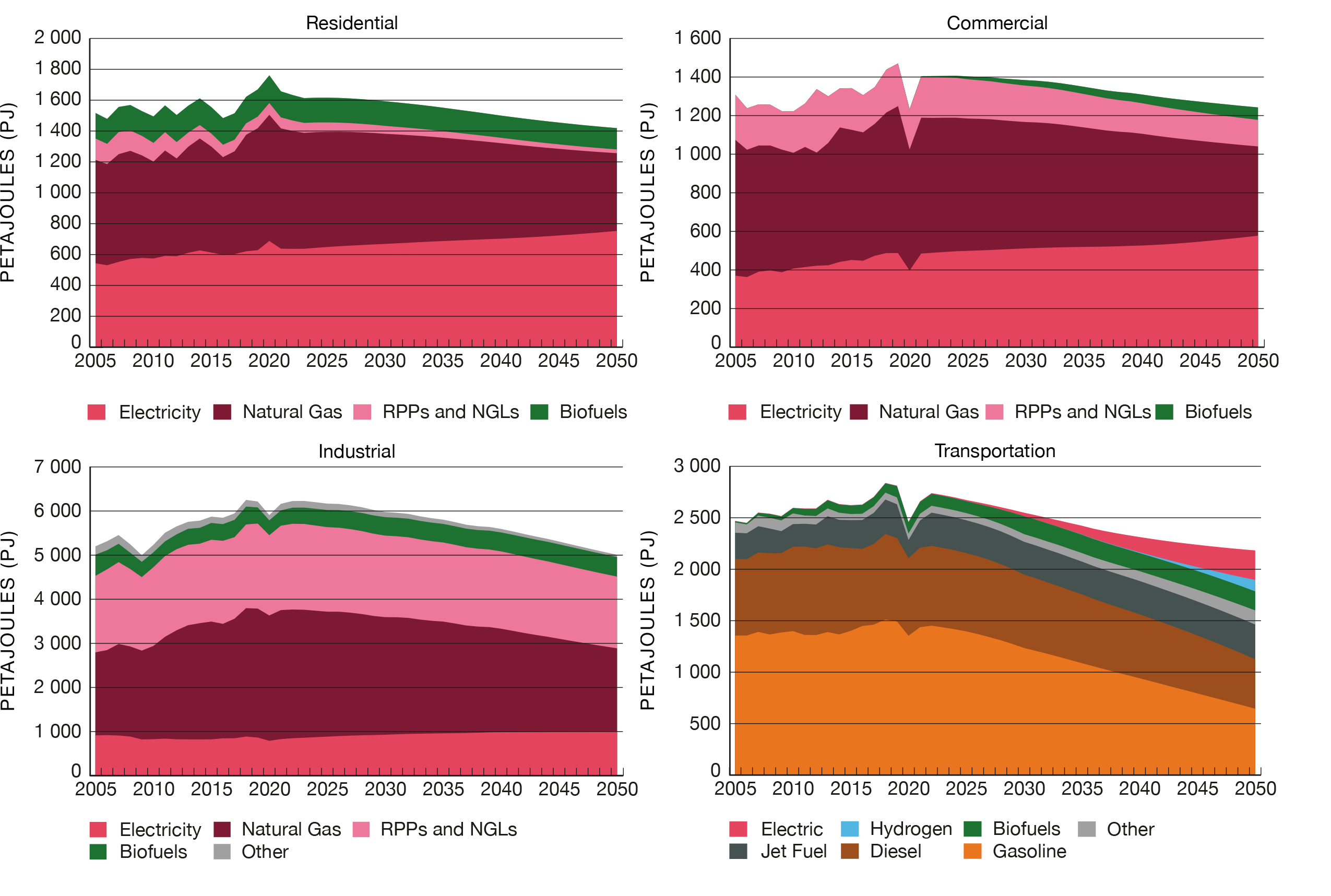

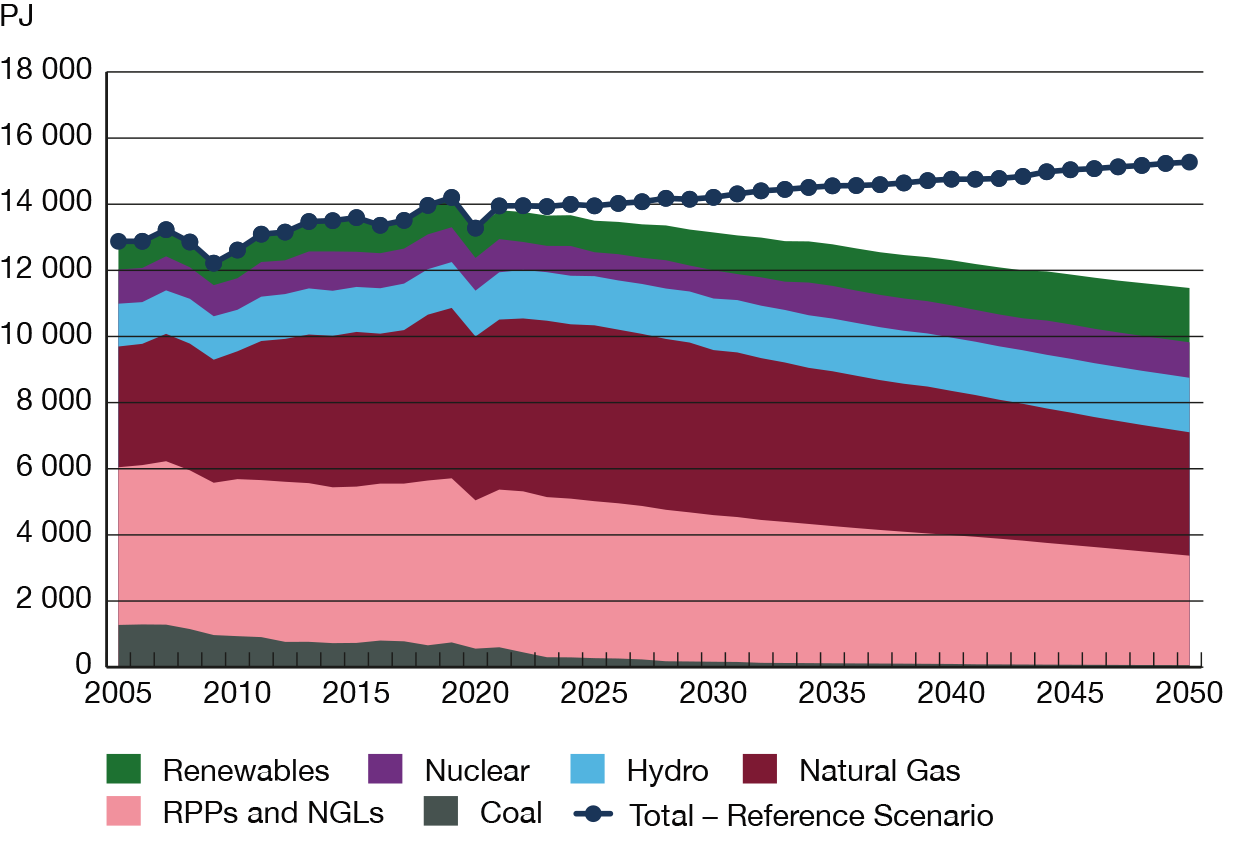

This section presents results of the EF2020 projections. The primary focus is the Evolving Scenario. These projections are not a prediction, but instead present possible future outcomes based on the assumptions described in the previous section. There are many factors and uncertainties that will influence future trends. Key uncertainties are included for each section.

For a description of the various ways to access the data supporting this discussion, see the Access and Explore Energy Futures Data section.

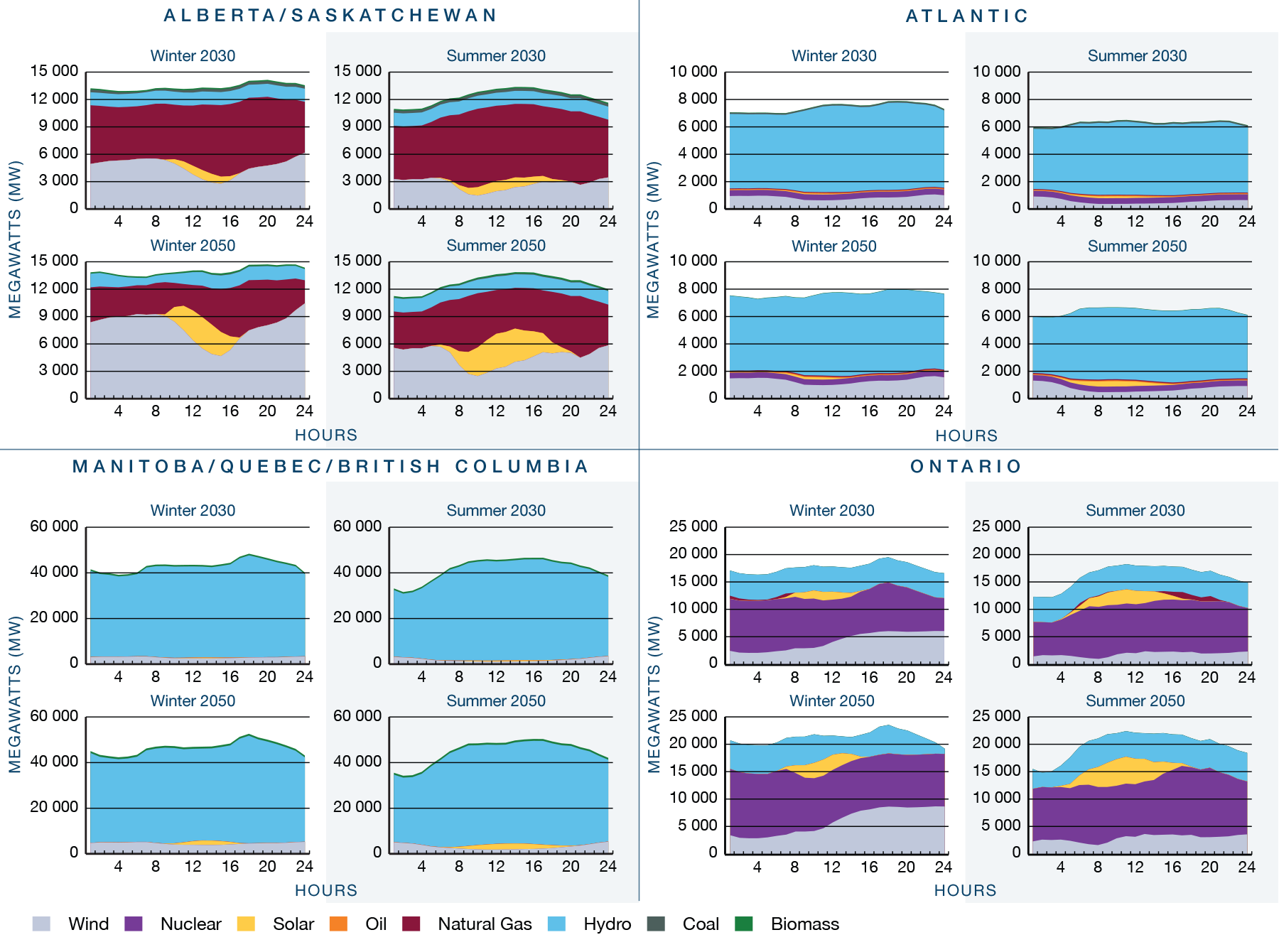

Description

Description