ARCHIVED – Electricity Cost Recovery Workshop – Summary of Workshop Discussion

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

File 175-A000-72-2

4 August 2005

To: All Electricity Companies under the National Energy Board's Jurisdiction and All Interested Parties

Dear Stakeholder:

Summary Report of the June 2005 Electricity Cost Recovery Workshop

Please find attached a summary report of the most recent industry workshop addressing cost recovery for the electricity industry. At this second workshop, a number of options and criteria were discussed in further detail. The summary report reflects the presentations, comments and discussion that took place. The report and other relevant documents are available on our Web site under Engaging Canadians and Electricity Cost Recovery Review (www.neb-one.gc.ca).

We invite you to submit your comments on the options presented in the report. You may also choose to provide an impact assessment of these options, to help the Board understand more clearly how these options might affect your operations. If you require background information to assist you in preparing your comments, the Board can provide nameplate capacity for the international power lines under its jurisdiction. Any feedback should be submitted by mail, courier or facsimile to the Board Secretary, Michel Mantha, by 7 September 2005.

The Board is in the process of developing the cost recovery concept based on the options and criteria discussed at the workshop. Your input will be helpful as this work gets underway. We anticipate that another workshop will be held in the late fall of 2005 to present the draft cost recovery concept. An invitation to this meeting will be sent to you once the details are finalized.

In the meantime, if you have any questions or comments, please feel free to contact me as indicated below:

Regulatory Development Analyst

Planning, Policy and Coordination

Canada Energy Regulator

Telephone: 403-292-4800

Telephone (toll free): 1-800-899-1265

Yours truly,

Stéphane Thivierge

for

Chantal Robert, P.Eng.

Project Manager

Summary of Workshop Discussion

Fairmont Queen Elizabeth Hotel, Montréal

2 June 2005

Table of Content

Please note: The Workshop Summary was prepared by the NEB. The workshop participants were asked to provide their comments on the summary to ensure the accuracy of their comments. These comments have been incorporated verbatim in a table on page 5. Please refer to these comments when reading the document.

- Executive Summary

- Comments from Participants

- NEB Presentations

- Discussion

- Conclusions and Next Steps

- Appendix I - Proposed Electricity Cost Recovery Options

- Appendix II - Proposed Criteria to Evaluate Cost Recovery Options

- Appendix III - List of Participants

Executive Summary

The National Energy Board's (NEB, the Board) Electricity Cost Recovery project was initiated in March 2004 as a result of the electricity industry expressing concerns about the cost recovery process, and requested a review of the methodology. The electricity industry members requesting the review believe that the current methodology is not equitable, since exporters are the only group paying NEB costs. These members also believe that the restructuring of the industry resulting in the separation of generation, transmission, distribution and marketing functions means that it is critical for costs to be more appropriately distributed.

Following the industry request, the NEB organized a day-long workshop in Calgary on 9 December 2004 to explore the issue further with industry participants. About 25 industry participants and Board representatives participated in the workshop. A second workshop was held on 2 June 2005 in Montreal, and was attended by 22 industry participants. At this workshop, Board staff provided additional background information and presented some draft options and criteria for industry's input and feedback.

This Workshop Summary Report provides a summary of the discussion at the workshop. The report is intended to reflect participants' comments in their own words, and the use of terminology in the report is consistent with participants' remarks. For clarification, it should be noted that the NEB only has jurisdiction over exporters and International Transmission Lines (IPLs), and so any reference to transmission owners in the report would only apply to transmission owners with international facilities.

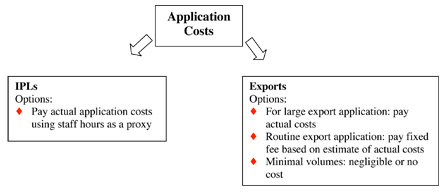

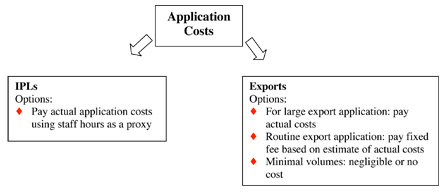

There were a number of principles that industry participants supported, for example, the user pay principle, especially for all applicants to pay the costs associated with their application. There was support for the following application cost options in principle.

Application Costs

Non Application Costs

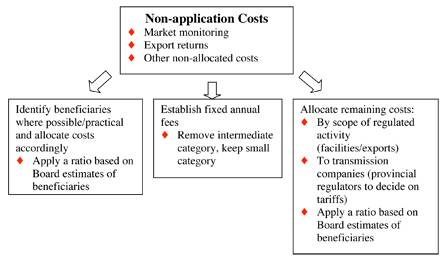

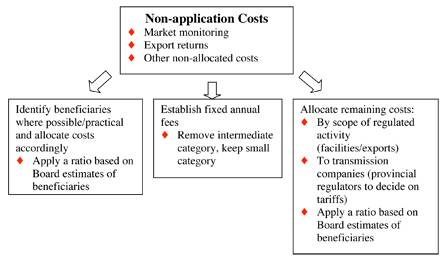

The group agreed that addressing cost recovery for applications was the easiest part of the process. Non-application costs were more difficult to address. With regard to non-application costs there was also support from industry for the principle that beneficiaries of services should pay for them. The following principles related to non-application costs were supported by the industry participants and were captured as follows.

Non Application Costs

Board staff put forward the following possible criteria to ensure the effectiveness of the solution and industry participants provided a range of feedback on the criteria presented.

- Compliance with legislative and other requirements

- Operational simplicity

- Equity

- Predictability/stability of charges

Board staff indicated that as part of the regulation amendment process, it was required to conduct an impact assessment to assess the economic, social, environmental and health impacts of the proposed changes on Canadian society. Board staff requested industry participants (individually or as a group) to provide their views on any potential impacts of these changes, along with their position and supporting rationale on any of the options discussed at the workshop. A written document should be formally submitted to the Board Secretary, Michel Mantha.

In the meantime, research on methodologies and service standards in other countries is being conducted. Board staff plans to make a draft concept available for review by industry in the fall of 2005.

Comments from Participants

Participants had an opportunity to review a draft workshop summary to ensure that their comments were accurately captured. Their verbatim comments are noted below, and should be referenced when reading the rest of the document.

| Page | Line | Comment | Company |

|---|---|---|---|

| Note: Page and line numbers refer to the current document in Adobe Acrobat [PDF 334 KB] | |||

| 17 | 2-3 | The IESO noted that it is not regulated by the NEB. That comment was made with respect to the items that were being discussed at the time. The NEB does have jurisdiction over the IESO with regard to permits for both "circulating power" and transactions surrounding "emergency energy". | Independent Electricity System Operator |

| n/a | n/a | The Summary of Workshop Discussion adequately captures the discussion at this meeting. | Manitoba Hydro |

| 15 | 7-13 | I believe that this discussion centred around "border accommodation" rather than just small facilities per se.; that is, customers across the border being served off a radial feed from the utility. These paths would not constitute wholesale market transfer paths in that one cannot typically deliver energy beyond the local distribution area. While I cannot speak for others, that was the intent of the support that I conveyed in this context. | Powerex Corp. |

| 16 | 26-31 | I do not believe the summary statement that is attributed to Powerex portrays my thoughts on the matter with sufficient clarity. To clarify the point, I generally agree with the premise that there should not be a distinction with respect to the basis or methodology of recovery (e.g., flat fees for some customers, volume based for others), with the exception regarding "border accommodations" noted above. The statement regarding using a capacity allocation simply reflects that within that particular methodology, participants of various sizes will be allocated different amounts based on their relative size. Otherwise, I believe the summary provides a reasonable representation of the topics covered at the workshop. | Powerex Corp. |

| Please could you refer to "Brascan Energy Marketing" rather than "Brascan" to clarify that the comments are coming from the export licensee rather than Brascan Corp., the holding company. | Brascan Energy Marketing Power Corporation | ||

| 10 | 42 | On page 10 at line 42, with respect to the costs associated with the Board's activities related to security regulations, it was also clarified by Board Staff that the security related regulations would be applicable to IPL's only. | Ontario Power Generation Inc. |

| 17 | 43 | On page 17, in the last paragraph, there are two comments attributed to Board staff which appear to be inconsistent. At line 42 it is noted that the "regulation could be written in such a manner to allow some flexibility". | Ontario Power Generation Inc. |

| 18 | 1 | On page 18 at line 1, "Board staff noted that the current regulation provides some discretion, but that the NEB Act requires that the actual charges be stated in the regulation". Particularly in light of the procedures necessary to change the regulation, I believe it would be helpful if the summary better indicated the degree of flexibility that exists. | Ontario Power Generation Inc. |

| 18 | Fig. | On page 18, with respect to the "identification of beneficiaries where possible/practical", OPG emphasized the practical limitations inherent in the identification of beneficiaries, given both the difficulty in identifying the beneficiary for particular work programs and the fact that the costs associated with some of the programs could vary substantially from year to year. | Ontario Power Generation Inc. |

NEB Presentations

Cost Recovery Regulations

Chantal Briand, Regulatory Development Analyst and Assistant Project Manager

The regulatory process involves six phases, from conception and development to implementation. Stakeholder consultation occurs in the first four phases: conception and development; drafting the regulations; examination by Justice and the Privy Council Office; and Pre-publication in the Canada Gazette, Part 1.

The new User Fees Act (UFA) promulgated in 2004 may apply in making regulatory changes to the NEB cost recovery for the electricity industry. Currently, Parks Canada is the first agency to have implemented the requirements of this act, but their mandate is so different from that of NEB that it is not clear as to whether or to what degree the UFA would be applicable. If applicable, the UFA would overlay an additional regulatory process. While this may result in an increased political aspect, the UFA would not impose any substantive requirements or restrictions for determining the fees involved.

During group discussion, Board staff was asked about the relationship between the UFA and the cost recovery regulations. Board staff indicated that the principle behind the UFA was that the user of services should pay for those services. Board staff noted that the UFA was the result of a Private Member's Bill and that the government was not involved in drafting the act, so the Department of Justice and the Treasury Board are less familiar with it compared to other legislation. The Board will be monitoring the situation and will be ready to address the UFA's requirements, if necessary.

An industry participant asked about the changes in the Policy on Service Standards for External Fees. This policy replaced the External Charging Policy in November 2004, since the previous policy was not compatible with the UFA. The new policy allows for flexibility in its application.

Board staff was asked about representation from other areas of government at the workshop. While there were two provincial regulatory bodies represented at the workshop, no federal bodies other than the NEB were in attendance. Board staff indicated that it is unusual for federal departments to be involved so early in the process. However, these departments have and will continue to receive all the information about the cost recovery project and will be kept up-to-date on the process. Board staff indicated that since the Board has hired a consultant to assist with the drafting of the new cost recovery regulations, perhaps it was less critical for the Department of Justice to attend the workshop as the department would normally be directly involved in drafting the new regulations. In the case of Natural Resources Canada, the department is not directly involved and any changes from the cost recovery project would only result in an administrative process for them. The Treasury Board is the body that is ultimately responsible, and the NEB will continue to keep them informed in a timely manner.

De-mystifying Cost Recovery Fees

Dan Philips, Team Leader, Finance

Not all costs incurred by the Board are recoverable. About 10 percent of the NEB's costs are nonrecoverable; these costs are related to frontier areas, work on behalf of other departments or agencies, and their associated overheads. In 2003, total NEB costs were $40.9 million. Electricity costs amounted to $4.3 million, about 10 percent of total costs. Electricity costs are rising relative to the other sectors. Industry participants commented that the increased costs should not be associated with export costs, since export volumes have been decreasing. Board staff noted that there have been four new IPL applications since 2001, with a long period prior to that with no applications. These applications have driven costs up.

For cost recovery, the Board uses the calendar year, even though its fiscal year ends March 31. Recoverable costs are defined by regulations (frontier costs are excluded by Order of the Board). The Board's costs are very labor intensive. About 75 percent of recoverable costs are associated with staff compensation. The remainder involves operating and maintenance expenses. The Auditor General performs an annual audit of the NEB's costs.

Currently, energy companies pay their share of recoverable costs in three ways:

- Greenfield levies (for pipeline start-ups only), or

- Fixed fees (small and intermediate pipeline companies and electricity exporters), or

- Sharing the remaining pool of costs by commodity sector

These last costs are allocated according to how much time Board staff spend on each sector. Specific hours are recorded, not percentages of time. All NEB staff, including Board members, use time reports to track their hours by commodity, but individual projects are not generally tracked. Board staff indicated that it would be possible to track individual projects such as facilities applications or export permits. There is some work that cannot be allocated to a specific sector because it relates to all the commodities, for example, Aboriginal consultation. Shared costs are based on activity, rather than dollars. In the case of electricity, the activity measure is MW.h; for pipelines, it is throughput volumes.

Board staff clarified that the greenfield fee applies to pipelines only - and only to pipeline companies that are not presently regulated by the NEB. The fee is a percentage of the capital cost of the project, and there is no connection to the cost of any hearing that may be required. Furthermore, the fee is only payable if the application is approved. If the application is denied, then the costs associated with the hearing are recovered from the Board's regulated companies. Once greenfield facilities are in-service, the pipeline company shares in the allocation of throughput costs with other industry participants.

A Canadian Electricity Association (CEA) representative wondered if it would be possible to develop an electricity cost recovery concept that would include application fees. There was support from the industry participants for all application costs being paid by the applicant. Board staff indicated that it is not presently possible to recover application costs from unsuccessful applicants that are not regulated by the Board. Recovery of application costs from such unsuccessful applicants would require a change to the National Energy Board Act and would take longer to accomplish than changes to the cost recovery regulations. Industry participants indicated that they would be interested in promoting this option for the long-term. Board staff indicated that it would bring this to the Board's attention.

Hydro One Networks indicated it supports the user pay principle, including recovering costs associated with any denied application. Board staff indicated that Sumas was an unusual case, and that it is not often that hearing costs are so high and the application is not approved. Usually, when an application is denied, the proponent revises and resubmits the application.

Hydro One Networks reiterated its support for the principle that the costs associated with a public hearing such as Sumas should be borne by the applicant. Coral Energy also supported the user pay concept and added that focusing on the bottom of the allocation 'cascade' creates concerns among the players. Those concerns would be alleviated somewhat if some costs were allocated further up the cascade, especially if applicants are required to pay hearing costs. This would result in reduced costs to be shared by industry participants.

A clarifying question was asked about the current process that requires a four-year rolling average to determine costs. Board staff confirmed that four years are involved: actuals for the two previous years, a current year estimate and forecast for the following year. The Board estimates its costs and adjusts the estimate when costs are finalized.

Board staff was asked where accountability lies for its budget. It was confirmed that the budget is approved by Parliament and that the Board is accountable to Parliament. However, collected cost recovery monies are not returned to the NEB, they go into the government's general revenues. It was also confirmed that the Board itself does not function as a board of directors; it is a regulatory board.

It was noted that there is also a Cost Recovery Liaison Committee that meets regularly, comprised of energy industry representatives and other stakeholders such as consumer groups. The electricity industry is represented by CEA on this committee, but membership is open to other electricity industry participants as well. Interest in participating has increased over the past 18 months.

The Cost Recovery Liaison Committee provides input on costs as well as other issues. For example, when the Board is seeking increased funding from Parliament, input from the Cost Recovery Liaison Committee is sought. The last time, the committee told the Board that it was being too conservative in its request. Some committee members wrote letters supporting additional funding. Committee input is also sought on staffing level issues and salary levels.

Board staff was asked about the role of the Auditor General. The Auditor General provides a critical function as it performs an annual audit of the NEB's costs and time reporting as well, since the latter is a proxy for costs. The NEB financial statements are tabled at the Cost Recovery Liaison Committee and are also posted on the NEB's Web site.

Board staff also noted that setting priorities is a management decision and that the executive team determines projects. An annual strategic planning session is held in the fall. The Board is largely driven by industry activities such as the number of applications submitted. In a year with many activities, the Board must reassess its priorities and reallocate workloads to adapt to emerging situations.

Board staff noted that it needs to keep two different sets of books - one to reflect its fiscal year ending March 31, the other to reflect its recoverable costs, which are based on the calendar year. Board staff asked industry participants if there would be any objection in shifting to a single set of books for both. Industry participants appeared to have no problem in moving to a single set of books based on the NEB fiscal year.

Overview of Electricity Program

Bob Modray, Technical Specialist, Economics and Energy Analysis

The NEB's mandate for electricity is included in the National Energy Board Act (NEB Act) and there are responsibilities under the Canadian Environmental Assessment Act (CEA Act). The NEB Act was recently amended following the implementation of the Public Safety Act, 2002. This will have implications for the NEB's oversight of facilities under its jurisdiction, including international power lines and will also impact the industry.

The Canadian Electricity Policy was created in 1988 to respond to industry restructuring and to support the shift to a market-based approach to regulating electricity. In response, the NEB Act was revised in 1990. For example, the need for prescriptive tests to determine if exports are surplus to domestic needs was removed. There have been no export hearings since 1990. All export applications have been handled on a permit basis. Export applications have tended to be more straightforward than applications for new IPLs. There is also ongoing regulatory work, including meetings requested by potential applicants.

The Board's responsibilities related to IPLs have been evolving, and now may address reliability and security issues. The Board was directly involved in the Canada-U.S. blackout task force and there is ongoing work in support of a federal/provincial/territorial reliability subcommittee. Board staff indicated that it is concerned with the reliability of the IPL only - but there is a broader impact on the provincial system. There are reliability benefits for the rest of the system associated with IPLs. The Board is interested in understanding reliability issues and the impact of North American Electric Reliability Council (NERC) standards, but indicated that the boundaries of authority between federal and provincial jurisdiction in this regard are not always clear.

A CEA representative wondered about the costs associated with the new security legislation and Board staff indicated that it was too early to determine all related costs now; the costs so far would relate mainly to the changes to the NEB Act. The changes empower the Board to make regulations on security. Board staff also indicated that there has been no increase in its budget to address security issues, and that resources will need to be reallocated. Board staff was asked whether security expenses would be recoverable and Board staff indicated they are recoverable.

A discussion about exports ensued. Board staff was asked whether there is a connection between the volume of exports and the number of export applications. Board staff indicated that the number of applications varies from year to year and the number of applications is what drives the Board's work - not export volumes. Board staff was asked how many export applications are 'reactive', i.e., applying for a licence 'just in case'. There is no annual fee to maintain a licence, but small exporters only pay a flat fee of $500, no matter how many licences they hold.

IPL applications are more involved and take more time. There have been four IPL applications in recent years, three of which resulted in public hearings. This compares with only a single IPL hearing during the 1990s.

A further discussion ensued about the Board's market monitoring activities. This issue was also raised at the workshop last December. Market monitoring activities arise out of the Board's mandate to provide an advisory function and to inform the public about the functioning of energy markets. The Board's monitoring function involves assessing issues and trends. In this way it is different from the type of monitoring carried out by Market Surveillance Administrators (MSAs) in some jurisdictions. MSAs seek out abuses of market power and ways to improve the effective operation of electricity markets.

Hydro-Québec TransÉnergie asked whether the information gathered during market monitoring activities could be directly applied to the Board's processing of export permits. Board staff indicated that the information is not used directly for processing applications, but that the reports are helpful in educating potential interveners and others about how the market works and what the issues are. This work assists Board Members and staff in carrying out their regulatory responsibilities. Market monitoring activities promote understanding of energy markets and the Board believes that this helps markets to function more efficiently.

Board staff indicated that its market monitoring activities do not include a survey of prices and that it would be difficult to allocate market monitoring costs to a specific sector. Board staff was also asked whether it had a test to determine if markets are working. Do Canadians have fair market access, for example? If the NEB decides that Canadians do not have fair market access, would or could exports be stopped? Board staff responded that in some cases, price data are available to help assess whether markets are working; if consumers are not being offered fair market access they can complain to the NEB. If an exporter is found to contravene the permit (e.g., fair market access is not offered), then presumably the permit could be revoked (and exports terminated).

Hydro-Québec TransÉnergie wondered whether fair market access was a reasonable criterion for Board staff to use in evaluating export applications. Reciprocity conditions might be a better criterion. Board staff indicated that reciprocity is a U.S. condition, not a Canadian one. For fair market access, the Board looks at whether Canadians can get access to electricity under similar conditions as the export market.

Hydro-Québec TransÉnergie also wondered whether the Board could stop exports, for example, if Ontario needed extra power. Board staff indicated that this scenario would need to be considered in the context of fair market access.

Board staff indicated that it is anticipating multi-commodity/convergence issues in the energy industry, for example, the implications of oil sands developments for natural gas cogeneration and electric transmission. Board staff also commented that FERC Order 888 required players in the U.S. market to unbundle their systems and offer access on a fair basis to everyone. There are also more players now, partly resulting from the utility unbundling. So the issues are becoming increasingly complex and the Board needs a good understanding of them.

Board staff indicated that there is currently a trend toward decreasing exports and increasing imports .This results from Canadian generation capability not keeping pace with growing domestic electricity demand. For example, in August 2002, Ontario was short of supply and had to import power. Other provinces have taken advantage of IPLs to import power because of drought conditions and economic opportunities that favour importing instead of using domestic generation. There have been 50-60 TW.h of electricity transfers (exports plus imports) in recent years. Hydro One Networks noted that it is not the responsibility of IPL owners to address shortfalls.

Hydro-Québec TransÉnergie asked whether export volumes are based on net or gross numbers. Board staff noted that import volumes are not factored in. The calculation is based on gross export volumes with one exception, equichange agreements. Equichange agreements require that exports and imports balance out over time; however, in a given reporting period, net exports (exports minus imports) are utilized for cost recovery calculations.

Discussion

Options

During the afternoon, Board staff and industry participants discussed a variety of possible options (mechanisms) that could be used in combination to create a concept or complete solution to address cost recovery. A number of these options had been proposed by industry participants at the December workshop. The following options were discussed:

New IPL application fee/greenfield fee:

- Pay actual estimated costs for each hearing (based on number of staff hours)

- Pay flat fee for category 1, 2 and 3 (category relates to the length or complexity of the hearing and would be decided at the end of the hearing with input from the company)

- Greenfield fee - form of application fee, based on the following potential parameters: facility, voltage level, name plate capacity, capital cost

Export authorization fee

- Flat fee for export permits

Non-application costs (all other costs)

- Transmission companies pay on installed capacity

- Transmission companies pay based on volumes of exports plus imports (net line utilization)

- Transmission companies pay based on existing IPL rated MW or MW.h

- NEB services (monthly export returns, market monitoring, etc.) paid by those who benefit from them

- Straight ratio (% for transmission companies and % for exporters)

- Increased annual charge for small and intermediate exporters

Application Costs

Board staff was asked how the cost of hiring consultants was addressed. Board staff indicated that the cost for consultants comes out of operating costs and that these costs are minor.

Board staff was asked about the gap between actual costs and estimated costs based on employee time allocation. The industry participants agreed that it is not necessary to have a 100 percent solution; a 75-80 percent achievement of the objectives was adequate. The Ontario Energy Board indicated that other regulators have used hours as a proxy. Few regulatory bodies try to track actual compensation costs. There was general support for the NEB to transition to a new time tracking system to track individual staff hours for each application, including export permits that require a hearing.

Board staff was asked if options related to application costs straddled over different fiscal years would be an issue. Board staff indicated that a hearing can take place sometimes over a 2-3 year period and that multiple years could be accommodated.

How are staffing issues addressed? Board staff indicated that it works in project teams and 'borrows' staff based on volume of work. All staff allocate their hours among the three commodities. While projects are not generally tracked, it would not be difficult to add a new project to the tracking system. There was general support from the industry participants for the NEB to track staff hours for each electricity application; this would include applications for both export permits and IPL certificates.

Board staff was asked whether estimates are forward 'guesses' or based on existing data. Board staff indicated that its estimates were based on actual data and that it is impossible to predict how a hearing will go.

While it is possible to track staff time associated with applications, it would be more difficult to track other operating costs such as hearing rooms without making some major revisions to the NEB accounting system.

Coral Energy noted that it did not make sense to tie application fees to the capital cost or other aspects of the project. What needs to be captured are the NEB's costs. The NEB's costs are not necessarily driven by capital cost, voltage or other aspects of a proposed project.

There was support from Hydro One Networks and Hydro-Québec TransÉnergie for IPL applicants to pay the actual costs for their hearings. NB Power Transmission Corporation wondered whether the application fees could be applied to all new IPL facilities, regardless of whether the applicant currently comes under the Board's jurisdiction or not.

While the industry participants supported the concept of all IPL applicants paying hearing costs, Board staff noted that it cannot charge a fee to an unsuccessful applicant that does not hold a Board authorization. Over the long term, there legislation would need to be changed to allow fees to be recovered from companies that are not regulated by the Board.

The industry participants were concerned about the recovery of costs associated with an unsuccessful application by an unregulated company such as Sumas. Board staff noted that this rarely occurs. Board staff noted that the Sumas application took a lot of the Board's time and that the cost of the application was higher than the cost of the IPL. Hydro One Networks questioned why other companies should subsidize those costs.

Hydro One Networks indicated its support for full cost allocation to the applicant for all projects including exports as well as transmission lines. When there is a hearing or extended process associated with exports, the associated costs should also be determined and recovered from the applicant. However, there has been no hearing for exports since 1990 and processing export applications may be fairly routine.

Ontario Power Generation noted that if export applications are now routine, it would be easy to calculate the cost based on staff hours as a proxy. Hydro One Networks indicated its support for this approach, but suggested that a flat fee could be created that would approximate the costs. Ontario Power Generation added that if a hearing is required, there could be a substantial increase in costs.

Board staff asked the industry participants how a flat export application fee could be determined. Hydro One Networks indicated that staff costs based on employee time could be tracked for a year or two. Board staff added that tracking could take place before the regulatory changes are implemented, and a baseline average could be determined.

Manitoba Hydro noted that in that province there is a very small export licence at the border for about 20 kW and questioned whether such a small export amount should trigger an export fee based on the average application costs. Manitoba Hydro indicated it would almost be tempted to cancel the licence. Board staff suggested using another criterion such as single phase vs three phase or voltage level. There was a discussion about possible exemptions for very small export volumes. Powerex and Hydro-Québec TransÉnergie supported a minimum capacity or volume below which there would be no fee.

In summary, there were a number of principles that the industry participants suggested, for example, the user pay principle, especially for all applicants to pay the costs associated with their application. The industry participants also agreed that a transition period would likely be necessary. There was support for the following options in principle.

Application Costs

Non-Application Costs

The group agreed that addressing cost recovery for applications was the easiest part of the process. Non-application costs were more difficult to address. These costs include market monitoring, export returns and other non-allocated costs. These costs could also fluctuate.

With regard to non-application costs, there was also support from the industry participants for the principle that beneficiaries of services should pay for them. There was a significant discussion about the services provided by the Board and who benefits from them or causes them. There was a discussion about basing non-application costs on installed transmission capacity, and whether that would be the combined transfer capability or the nameplate capacity of the individual IPL. Hydro-Québec TransÉnergie indicated that it did not support any solution that would use total installed transmission capacity as a basis for non-application costs. Neither would the Board have jurisdiction to mandate that approach, since the Board only has jurisdiction over IPLs. Both TransÉnergie and Brascan Energy Marketing supported utilization rather than installed IPL capacity as a basis for cost recovery. Brascan Energy Marketing also noted that if the well-being of the Canadian consumer is being protected, then consumers are the ones who should be charged, perhaps through distribution companies somehow.

Powerex noted that if installed capacity was used as a basis, then exporters would be paying some portion of the costs through transmission tariffs. Powerex added that there could be a different mechanism to capture value in transmission rates that could reflect the benefits to importers as well as reliability benefits. Board staff noted that nameplate capacity is auditable and stable. NB Power Transmission did not support a solution based on installed capacity, noting that it was building an interconnection that would function at a lower capacity than its nameplate rating because of restrictions in the U.S. market. Manitoba Hydro indicated that installed capacity or something similar would be the best proxy of value, since it provides a fair representation among all transmission companies and the costs would be shared on a relative basis, in any case. Manitoba Hydro said this approach is fair because the decision on how large to size an IPL is a conscious decision, i.e., if the utility designs it with an installed capacity greater than the level of exports that can be supported by the system, that's a choice, not an obligation. During this discussion, Manitoba Hydro indicated that information such as nameplate capacity or simultaneous transfer capacity might be useful in determining the extent of cost shifts that would result from changing the cost recovery methodology. NB Power Transmission also wanted to review the data to see if, indeed, that were the case.

Board staff asked whether the industry participants wanted to make a distinction between small, intermediate and large companies for the purposes of recovering non-application costs. Hydro One Networks indicated that there should not be any distinction unless one group is underpaying their share. Powerex added that if allocation is on a capacity basis, that would essentially create that distinction. Some industry participants indicated that dropping the intermediate category could be appropriate.

Board staff wondered whether having the NEB decide an allocation based on beneficiaries was appropriate. Each region might have different systems and different beneficiaries. Perhaps each province should determine who should be paying. Manitoba Hydro suggested a two-step cost allocation process, with the first step to allocate costs to each jurisdiction. Then each transmission provider could determine with their provincial regulator how to reallocate the costs. The point was made that ultimately provincial regulators would be in control of if and how costs would be passed on if they were initially charged to transmission companies.

Hydro One Networks indicated that their transmission rates are 'postage stamp', so there might not be a meaningful reallocation to beneficiaries. The Ontario Energy Board added that while they do not handle rate cases every year, there is cost recovery of general costs, and that from their perspective, it would make sense for cost reallocation to be determined by provincial regulators. There was an ensuing discussion about the appropriate entities to be charged by the Board, since the Independent System Operators (ISOs), where applicable, are responsible for reliability, a factor associated with benefits. It was noted that FERC charges both the ISOs and the Transmission Facilities Owners (TFOs) for recovery of costs. The Independent Electricity System Operator of Ontario (IESO) noted that it doesn't own or operate facilities and that they are not regulated by the NEB. The IESO suggested that a given solution shouldn't be adopted just because it is easy to implement.

Coral Energy noted that both the TFOs and ISOs are not the ultimate beneficiaries for non-application costs and that the provinces are in the best position to make that decision.

Hydro One Networks asked who the beneficiaries are for export returns. Board staff indicated that it was a statutory requirement to provide this information. Hydro-Québec Production noted that it was not a beneficiary of these reports since it supplied the data in the first place.

It was noted by the industry participants that the criterion of causality works well with applications but not with other costs. These are charges the Board incurs because of its specific mandate. There is a need to focus on equity and a mechanism to determine who should pay. It was suggested by some industry participants that it would not be fair to shift all costs to IPLs. There could be discussion all day about beneficiaries without any resolution. It could be consumers; it could ultimately be the economy of Canada.

Hydro One Networks wanted to see some kind of equitable allocation for material/substantive costs, with as much allocated as possible according to beneficiaries. Board staff asked what would constitute material or substantive costs. Hydro One Networks indicated that monthly export returns, at eight percent of the Board's costs, would be considered substantive. Perhaps monthly export returns could be worked back into application costs since the returns are required for the exporters to maintain their permits. After all the costs have been allocated this way, the remaining costs should be divided equitably somehow.

The largest component of non-application costs is market monitoring. There was a long discussion about who benefits from this work. The work does help the Board and thus indirectly benefits exporters/marketers and IPLs. It was suggested by some industry participants that these two groups could share those costs based on some kind of ratio that reflects the amount of work undertaken by the Board. Such ratio could be reviewed on a regular basis to determine if they are still appropriate and the ratio changed as necessary. That would address almost half of the non-application costs. That solution might be acceptable to everyone, including customers and there would be no shifting of the burden from one sector to another. Some industry participants also indicated that shifting the total burden to the IPLs might not be perceived well by the provincial regulator, although that might work for a transitional period. It was not clear whether all provincial regulators would approve IPL costs being passed through to customers. Hydro One Networks noted that regulators could ask the IPL to offset the cost elsewhere.

Ontario Power Generation wondered whether it would be easy to change the ratio as required. Board staff indicated that the regulation could be written in such a manner to allow some flexibility. Hydro-Québec TransÉnergie supported the principle of using criteria in the regulation, so that the numbers can be adjusted as appropriate. The Ontario Energy Board noted that it has a new cost recovery model with an extremely simple one-page regulation that allows significant discretion. Board staff noted that the current regulation provides some discretion, but that the NEB Act requires that the manner of calculating charges be stated in the regulation. The following principles were supported by the industry participants and were captured as follows.

Non Application Costs

Hydro-Québec TransÉnergie noted that the definition of beneficiaries and benefits is very important, and that 'benefits' really relate to the reasons why the Board is undertaking a certain activity. Why is the Board doing market monitoring? Is it truly to determine if the market is working in Canada? Rather, the Board is mandated to undertake these activities. It is a cost of business due to companies that are required to be regulated by the Board. Coral Energy believed that the people of Canada are the true beneficiaries.

Hydro One Networks believed that market assessments are done to help the Board make decisions on export permits and that is how those costs should be allocated. Others believed that the costs could not be associated with a direct beneficiary. Board staff noted that these non-application costs need to be recovered in some manner, regardless of whether there is a perceived direct benefit or not.

Criteria

To help create the most effective solution, Board staff suggested the following criteria and asked for industry's input.

- Compliance with legislative and other requirements

- Operational simplicity

- Equity

- Predictability/stability of charges

Hydro One Networks suggested that it should be possible to change the legislation, but Board staff noted that that was not an option at the moment, although it could be considered for the long term. There was agreement that predictability and stability of charges was desirable and the four-year rolling average was a good mechanism.

Board staff asked if there were any other criteria that should be considered such as flexibility. Hydro One Networks noted that equity was an important criterion and that flexibility was an enabler to achieve equity.

Board staff raised the issue of the transparency of the parameters used such as numbers related to transmission capacity. From what authority should the numbers be derived? Would reliability council data be acceptable? Would industry accept numbers from a utility in another province or numbers supported by the local provincial regulator? Powerex noted that NERC provides a bigger picture and that path ratings tweaking will not happen.

The industry participants indicated that cost causation is also a criterion and that cross-subsidization from one group to another should not occur.

When the industry participants were asked about the weighting of the criteria, Hydro-Québec Production indicated that equity should be the main driver. NB Power Transmission indicated that cost causation should be main driver, although that criterion may be linked to equity. Powerex also agreed about the relative importance of cost causation, while Brascan Energy Marketing supported equity as the main driver, as well as the ability to adjust to market conditions in the future. There was support for adaptability as an additional criterion.

Hydro One Networks identified equity as the most important criterion and cited as well the need to make the process fair and transparent.

Powerex supported the need for simplicity. The ultimate solution should not be too complicated or require significant additional costs to satisfy the process. This will also help make the solution more predictable/stable.

Powerex wanted clarification of what was meant by predictability/stability, whether it related to the measures, such as installed capacity, or to the costs charged to each sector. Hydro-Québec Production indicated that it could not relate to costs, since there was no way the costs associated with the Sumas 2 application could have been avoided. The company supported the principle that the measures should be predictable. Hydro-Québec TransÉnergie suggested that cost shifting should be avoided. Manitoba Hydro indicated that since a two-year process was needed to confirm costs, there would be plenty of advance warning, and therefore the costs would be predictable. However, if there was any cost shifting among groups, the more quickly this was accomplished, the more equitable the process would be.

Conclusions and Next Steps

A draft summary report of the workshop will be distributed to industry participants for review to ensure its accuracy. Industry participants wanted two weeks to provide its comments. A written document should be formally submitted to the Board Secretary, Michel Mantha. Industry participants indicated their interest in moving the process along quickly and said they would be able to provide its input two weeks from the date that the draft summary report was made available.

Board staff indicated that as part of the regulation amendment process, it was required to conduct an impact assessment to assess the economic, social, environmental and health impacts of the proposed changes on Canadian society. Board staff requested industry participants (individually or as a group) provide their views on any potential impacts of these changes, along with their position on any of the options discussed at the workshop and supporting rationale. A written document should also be formally submitted to the Board Secretary, Michel Mantha.

In the meantime, Board staff will create a draft concept on cost recovery methodology and will make it available for review in the fall of 2005. The industry participants were asked their preference for providing input and the industry indicated that another group meeting with an opportunity to provide written feedback would be appropriate.

Participants reiterated the need to be timely and move the process along as quickly as possible. Board staff indicated that hiring a consultant to draft the regulations and having him attend the workshop will help facilitate the process.

Electricity Cost Recovery Project

175-A000-72-2

Appendix I

Proposed Electricity Cost Recovery Options

Definitions:

Option: the means or mechanisms used to achieve the desired end result.

Concept: One or a combination of mechanisms, including details such as the formulas for how each mechanism will be applied.

Proposed Options to amend the Electricity Cost Recovery Regulations

New international transmission power line (IPL) application fee / Greenfield fees:

- Pay actual estimated costs for each hearing (based on number of staff hours).

- Pay flat fee for category 1, 2 and 3 (category relates to the length or complexity of the hearing and would be decided at the end of the hearing with input from the company).

- Greenfield fees: form of application fee. Fees could be based on the following

potential parameters:

- Facility (e.g., single phase or 3 phases)

- voltage level

- name plate capacity of the line

- capital cost to construct the line

Export authorization fee

- Flat application fee for export permits.

Non-application costs (all other costs)

- Transmission companies to pay based on installed capacity.

- Transmission companies to pay based on the volume of exports or on exports plus imports (the total utilization of the line).

- Transmission companies to pay based on existing IPL rated megawatts or megawatts/hour

- NEB services (monthly export returns, market monitoring, etc) to be paid by those who benefit from them.

- Straight ratio (% for transmission companies and % for exporters).

- Increase the annual charge to small and intermediate electricity exporters.

Electricity Cost Recovery Project

175-A000-72-2

Appendix II

Proposed Criteria to Evaluate Cost Recovery Options

| Criterion | Description |

|---|---|

| Compliance with legislative and other requirements | Collection of recoverable costs in compliance with applicable legislation: Section 24.1(1) of the National Energy Board Act, Financial Administration Act, User Fees Act and related regulations, Government of Canada policy on Service Standards for External Fees, 29 November 2004. |

| Operational simplicity | The method should be relatively easy to implement and use for both the NEB and industry. |

| Equity | The interests of various stakeholders should be balanced. |

| Predictability /Stability of charges | Predictable revenues to cover the Board's annual expenses and to allow companies to predict with reasonable accuracy what their cost recovery bills will be in a given year (avoiding highly inconsistent annual cost recovery revenues and an undue administrative burden). |

| Cost causation | This is based on the 'user pay' principle. To the extent possible, costs should flow to the parties who caused these costs to be incurred. |

Definition of criterion/criteria: A standard, rule, or test on which a judgment or decision can be based.

Electricity Cost Recovery Project

175-A000-72-2

Appendix III

List of Participants

| Company | Attendees | Title |

|---|---|---|

| Brascan Energy Marketing Power Corporation | Daniel St-Onge | Director, Marketing |

| Brascan Energy Marketing Power Corporation | Peter Bettle | Manager, Market Affairs |

| Canadian Electricity Association | Dan Goldberger | Senior Advisor, Finance & Tax Issues |

| Canadian Electricity Association | Francis Bradley | Vice President |

| Canadian Electricity Association | Gordon Aitchison-Drake | |

| Chymko Consulting Ltd | Nigel Chymko | President (Consultant for the NEB) |

| Chymko Consulting Ltd | Clyde Carr | Senior Project Manager (Consultant for the NEB) |

| Coral Energy Canada Inc. | Paul Kerr | Manager, Market Affairs |

| Hydro One Networks | Mark Graham | Director, Supply and Interconnections |

| Hydro-Québec Production | Erik Bellavance | Senior Advisor |

| Hydro-QuébecTransÉnergie | F. Jean Morel | Directeur, Aff. jur. TransÉnergie |

| Hydro-Québec TransÉnergie | Yves Dallaire | Chargé de projet, développement des affaires |

| Independent Electricity System Operator | Kim Warren | Manager, Regulatory Affairs |

| Manitoba Hydro | K.J. (Kelly) Hunter | Market Access Officer |

| National Energy Board | Valerie Katarey | Business Leader, Integrated Solutions |

| National Energy Board | Chantal Robert | Project Manager |

| National Energy Board | Chantal Briand | Assistant Project Manager |

| National Energy Board | Tim Kucey | Market Analyst, Electricity |

| National Energy Board | Bob Modray | Technical Specialist |

| National Energy Board | Dan Philips | Team Leader, Finance |

| National Energy Board | Karla Reesor | Facilitator |

| National Energy Board | Alex Ross | Counsel |

| NB Power Transmission Corp. | Wayne Snowdon | Vice-President, Transmission |

| NB Power Transmission Corp. | Chantal St Pierre | Manager, Regulatory & Environmental Affairs |

| NorthPoint Energy | Pat Hall | Chief Financial Officer |

| Ontario Energy Board | Catherine Barker-Hoyes | Managing Director of Business Services |

| Ontario Energy Board | Laura Cooney | Controller |

| Ontario Energy Board | Melanie Sangster | Manager, Business Services & Planning |

| Ontario Power Generation Inc. | Barry A. Green | Director Markets and Research |

| Powerex Corp. | Mike MacDougall | Manager, Trade Policy |

| Régie de l'énergie du Québec | Monique Rouleau | Conseillère en réglementation économique |

| Sari Shernofsky Corporate Communication | Sari Shernofsky | Consultant for the NEB |

| Société de transmission électrique de Cedars Rapids Ltée | Stéphane Verrett | Directeur général |

| Patrick Orr | Barrister & Solicitor(Consultant for the NEB) |

- Date modified: