ARCHIVED – Electricity Cost Recovery – Proposed Amendments to the National Energy Board Cost Recovery Regulations

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Proposed Amendments to the National Energy Board Cost Recovery Regulations

19 January 2006

NEB Cost Recovery - Information Session Agenda

- Welcome and Introduction

- Proposed Cost Recovery Concept as Approved by the Board

- New Cost Recovery Process

- Next Steps - Regulatory Process

- Adjourn at 3:30 p.m.

NEB Cost Recovery - Concept Background

- The Board regulates in the Canadian public interest within the mandate set by Parliament

- Focus on cost recovery for the Board’s overall regulatory responsibility

- Industry’s input was valuable when developing the proposed concept

NEB Cost Recovery - Concept Background

- Commodity charging approach consistent with oil and gas sector of activities

- Simple to develop and administer

- Equitable approach

NEB Cost Recovery - Concept

- Levy on newly regulated international power line companies

- levy of 0.2% of project capital costs

- Levy on the international power line companies regulated by the NEB

- actual energy transmitted in MW.h (international exports and imports)

NEB Cost Recovery - Concept

- Company classification and definition:

- Small, large and border accommodation categories

- Using existing definition with appropriate changes

- Year End Change

- NEB cost recovery year will align with the NEB fiscal year

NEB Cost Recovery - Concept

Proposed Cost Recovery Process

Based on the NEB Concept

Levy on Newly Regulated IPLs

- Parallels greenfield fee concept in oil & gas

- Payable by IPL companies

- not previously regulated by NEB

- will apply to new power lines approved by the Board

Levy on Newly Regulated IPLs (continued)

- Set at 0.2% of capital cost as estimated by the Board in issuing the certificate or permit

- Applies upon approval of certificate or permit

- invoiced after certificate or permit issued

- payment due 90 days after invoice date

Cost Recovery from IPLs

- The electricity commodity recoverable cost pool will continue to be determined as in the past

- Pool will now be shared by IPLs instead of electricity exporters

- Measurement parameter for sharing costs among IPLs -> MW.h transmitted by each regulated IPL (international exports + imports)

Cost Recovery from IPLs (continued)

- Recoverable cost pool to be shared by large companies in the proportion that each company’s activity (MW.h transmitted - i.e. international exports + imports) is to the aggregate of activity by all large companies

Cost Recovery from IPLs (continued)

- The actual pool to be shared by large companies will be determined as follows:

- Calculate commodity recoverable cost pool using present methodology

- Deduct: Fees levied in the year on newly regulated IPLs

- Deduct: Annual fixed fees charged to small companies (@ $500 per company)

- Deduct: Border accommodations fees (if any)

- Equals: Pool of costs to be shared by large IPLs

Cost Recovery from IPLs (continued)

- Will now require IPLs to report activity – MW.h transmitted

- For cost recovery, will require aggregate annual data:

- forecasts of activity for current and upcoming year

- actual activity for previous year

- no averaging

- transition into new process to be determined

Cost Recovery from IPLs (continued)

- Will continue process of invoicing on an estimated basis for the year

- After the year has passed, results will be audited

- Adjustments, if any, are factored into next billing cycle

Company classification

- Retain concept of company classification according to size

- Implement industry recommendation to use only 2 size-related categories

- Intermediate eliminated - leaving small and large categories

- Small companies continue to pay fixed fee - $500

- Large companies will share in cost pool

Company classification (continued)

- Small company will be defined as person transmitting less than 50,000 MW.h of power in the year

- All remaining regulated IPLs will be classified as large

- Border accommodation companies will remain, but definition will be amended to remove reference to exports

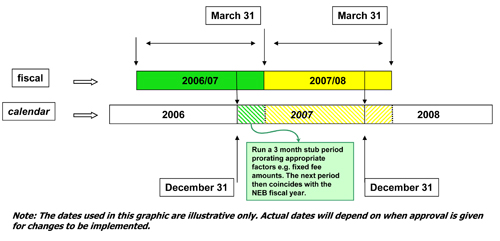

Year End Change Transition Plan

- This change will significantly reduce NEB workload

- Eliminates an entire year end closing cycle from our schedule

- Will transition by using a 3 month stub period Appropriate modifications to work calendar will be made e.g.:

- timing of calls for actual & forecast activity information

- timing of billing cycle

- timing of audit

Year End Change Transition Plan

Year End Change Transition Plan

Slide description

Fiscal Year: Ends March 31

Calendar Year: End December 31

Run a 3 month stub period prorating appropriate factors e.g. fixed fee amounts. The next period then coincides with the NEB fiscal year.

Note: The dates used in this graphic are illustrative only. Actual dates will depend on when approval is given for changes to be implemented.

NEB Cost Recovery - Comment Period

- Written comments should be mailed or faxed to the Board by 20 February 2006

- Comments shall be addressed to the Secretary of the Board

NEB Cost Recovery - Comment Period (continued)

- The Board will consider and respond to stakeholders written comments

- Regulation drafting process should begin after the comment period is completed

- Stakeholders will have other opportunities to comment before the promulgation of the regulations

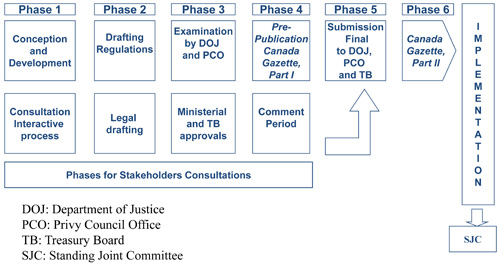

Regulation Process

Regulation Process

Slide description

Phase 1:

- Conception and Development

- Consultation: Inateractive process

Phase 2:

- Drafting Regulations

- Legal drafting

Phase 3:

- Examination by DOJ and PCO

- Ministerial and TB approvals

Phase 4:

- Pre-Publication Canada Gazette, Part I

- Comment Period

Phases 1 to 4: Phases for Stakeholders Consultations

Phase 5:

- Submission Final to DOJ, PCO and TB

Phase 6:

- Canada Gazette, Part II

IMPLEMENTATION

SJC

DOJ: Department of Justice

PCO: Privy Council Office

TB: Treasury Board

SJC: Standing Joint Committee

Thank you!

- Date modified: